Remember when energy analysts were scaring everyone with the concept of “Peak Oil”? The theory was that global oil production had peaked and as a result, prices would shoot up to $200 a barrel and the cost at the pump would top $10 per gallon.

Flash forward to this past week, when West Texas Intermediate (WTI) and North Sea Brent Crude touched new four-year lows. (The Energy Information Agency provides a good description of the two benchmarks here.) The combination of the U.S. shale boom and weakening Chinese and European demand has pushed down oil prices 30 percent since June. And according to the International Energy Association, lower prices are likely to continue into the first half of next year. Short of a geopolitical flare up, the IEA believe the we are entering “a new chapter in the history of the oil markets.”

The Energy Information Agency said that US oil production reached 8.9 million barrels per day in October, the highest monthly production since July 1986. The agency is forecasting that production will average 9.4 million barrels per day next year, which would be the most since 1972. As a result, the government cut its forecast for global oil prices next year by $18 a barrel to $83. The EIA notes that a $1-per-barrel change in the price of crude oil translates into a change of about 2.4 cents per gallon of gasoline (There are 42 gallons in one barrel, and 2.4 cents is about 1/42 of $1) and so the agency also predicts that the average price of gas will be below $2.94 a gallon next year, a 44-cent drop from an outlook issued a month ago.

If that holds, consumers will save $61 billion on gas compared with this year. That may not seem like a lot in the context of a $17.5 trillion U.S. economy, but economists say it matters because it immediately gives consumers more money to spend on other things…like holiday shopping!

Before we get too ahead of ourselves with visions of sugar plum fairies and the like, you may wonder if there is a downside to the drop in oil. A recent Sanford C. Bernstein report noted that oil at $80 a barrel makes one-third of U.S. shale oil production uneconomical. If that’s the case, there is a fear that state economies like Texas and North Dakota which combined, account for about half of the nation’s oil production, could take a hit to their energy-dependent economies.

But any pullback on the local level is likely to be outweighed by a more general increase in economic growth. Estimates range from a 0.3 to 0.5 percent bump in fourth quarter GDP from lower oil and gas prices. That might not seem like a lot, but it sure would come in handy for the holidays and kick US growth into a higher gear.

There was one other piece of good news for US consumers: College costs are still rising, but at a slower pace. According to a report from the College Board, tuition and fees for four-year public colleges averages $9,139 for in-state students, an increase of less than 1 percent after inflation (Room and board adds $9,804 to the total bill). In 2009-2010, the annual increase at public institutions was 9.5 percent. Tuition and fees for four-year private nonprofit colleges were $31,231 ($42,419 with room and board), up 1.6 percent after inflation, down from the recent peak in price growth of 5.9 percent in 2009-2010.

The College Board issued a separate report, which found that students and parents borrowed $106 billion in the 2013-2014 academic year from the federal government and other sources, down nearly 8 percent from the previous year after accounting for inflation, and down 13 percent from 2010-2011 peak of $122.1 billion.

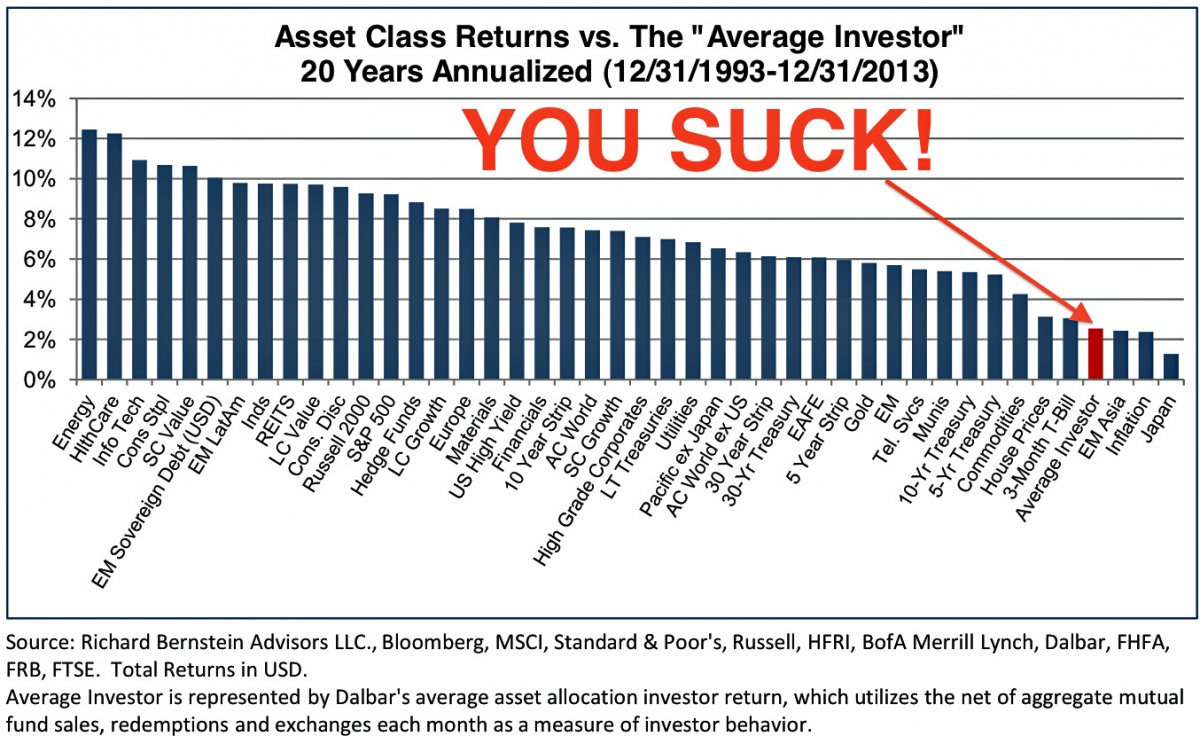

MARKETS: With stock indexes at record highs, investors are feeling good. The latest survey from the American Association of Individual Investors found that bullishness spiked to a four-year high of nearly 58 percent. Bearish sentiment, or expectations that markets will fall over the next six months was at 19.3 percent, below the historical average of 30 percent. If you believe that investors are often happiest at the wrong times, this could be seen as a warning…

- DJIA: 17,634, up 0.4% on week, up 6.4% YTD

- S&P 500: 2039, up 0.4% on week, up 10.4% YTD

- NASDAQ: 4688, up 1.2% on week, up 12.3% YTD

- Russell 2000: 1174, up 0.05% on week, up 0.9% YTD

- 10-Year Treasury yield: 2.32% (from 2.30% a week ago)

- December Crude Oil: $75.82, down 3.6% on the week (7th consecutive weekly loss)

- December Gold: $1185.60, up 1.3% on the week

- AAA Nat'l average price for gallon of regular Gas: $2.88 (from $3.21 a year ago; longest decline in gas prices since 2008)

THE WEEK AHEAD: Freddie Mac said fixed mortgage rates are hovering near 2014 lows, with 30-year fixed-rates averaging 4.01 percent, down from 4.35 percent a year ago. Will those low rates spur housing activity? We’ll learn more this week, when reports on Housing Starts and Existing Home Sales are released.

Mon 11/17:

Urban Outfitters, Tyson, Agilent

8:30 Empire State Manufacturing Survey

10:00 Industrial Production

Tues 11/18:

Home Depot, TJX

U.S. Senate may vote to approve the Keystone XL pipeline

8:30 Producer Price Index

10:00 NAHB Housing Market Index

Weds 11/19:

Target, Staples, Lowes, Williams-Sonoma

8:30 Housing Starts

2:00 Fed Minutes

Thurs 11/20:

Best Buy, Dollar Tree, Gap

8:30 Weekly Jobless Claims

8:30 Consumer Price Index

10:00 Philadelphia Fed Survey

10:00 Existing Home Sales

Fri 11/21:

Ann Taylor, Foot Locker

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)