As the heated talk over tariffs dominated the financial news, you might have missed a notable fact: housing affordability has dropped to its lowest level in nearly a decade. That’s a shame, considering that the economy is picking up steam and incomes are finally creeping higher.

Asset Allocation, Annuities and The Truth Behind the GDP

First up this week was Alan in Florida who has 80% of his whole portfolio in one stock. Believe it or not, this factoid does not have Alan freaked out! I, however, am not too excited about this strategy.

Next we went to the Bay Area and chatted with Linda who just inherited a variable, non-qualified annuity. Since Linda and her husband don't really need the money, they want to redirect it to a family member. Is there an easy way to do it?

In hour two we chatted with journalist and author David Pilling about a subject that's near and dear to my heart...our endless obsession with economic growth and the Gross Domestic Product.

In his latest book, The Growth Delusion: Wealth, Poverty, and the Well-Being of Nations, Pilling reveals the hidden biases of economic orthodoxy and explores the alternatives to GDP, from measures of wealth, equality, and sustainability to measures of subjective wellbeing.

We live in a world where economists basically set the framework for public debate. Ultimately, it is the perceived health of the economy which determines how much we can spend on our schools, highways, and defense; economists decide how much unemployment is acceptable and whether it is right to print money or bail out the banks.

The current backlash might suggest that people are turning against the experts and their faulty understanding of our lives. Despite decades of steady economic growth, many citizens feel more pessimistic than ever and are using their votes to have their voices heard.

For too long, economics has relied on a language which fails to resonate with people’s actual experience, and the pages of this book outline why we may now be living with the consequences.

Have a money question? Email us here or call 855-411-JILL.

Connect with me at these places for all my content:

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.linkedin.com/in/jillonmoney/

http://www.stitcher.com/podcast/jill-...

"Jill on Money" theme music is by Joel Goodman, www.joelgoodman.com.

Tax Cut Fails to Spur Growth

What happened to the tax cut bump to economic growth? After expanding by a brisk 2.9 percent in the fourth quarter of last year and the 3.3 percent rate in the third quarter, the economy decelerated a bit in the first quarter to an annualized pace of 2.3 percent, consistent with good, not great growth.

The Key to Economic Growth: Productivity

Forget job creation, tax cuts and returning any sector back to its glory days. After running into (read: stalking) former Federal Reserve Chair Ben S. Bernanke in the CBS This Morning Green Room last week, he reminded me that the REAL key to boosting economic growth and more importantly, your living standard, is labor productivity. The reason is easy to understand: “In the long run, what we can consume as a nation is closely tied to how much we can produce,” wrote Bernanke more than a decade ago.

Trump Tax Tease

President Trump’s “new” tax plan looked an awful lot like his old one from the campaign, though with far fewer details. The one-page overview was more like an incomplete set of bullet points, than a blueprint. For example, the plan would reduce the number of tax brackets from seven to three - 10, 25 and 35 percent, but there was no breakdown of income levels to which the new rates would apply. It also intends to provide a break for child and dependent care expenses, but did not specify the dollar amount.

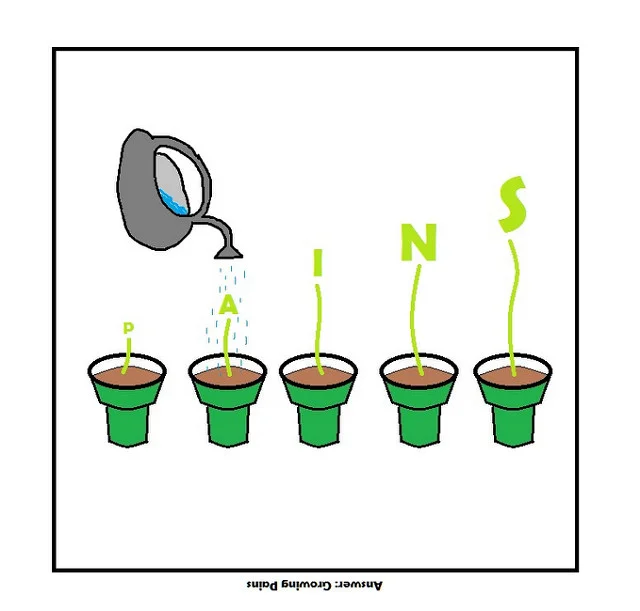

Economic Growing Pains 2017

"The simple message is the economy is doing well," Federal Reserve Board Chair Janet Yellen said in the press conference that followed the central bank’s third quarter-point rate hike in 15 months. She went on to say "We have confidence in the robustness of the economy and its resilience to shocks." You might be wondering what exactly “well” means. Let’s start with the long-term economic growth rate, which has averaged about three percent annually for the 50 years from 1966 through 2016.

Tired Stock Markets and Fed Fatigue

I'm tiredTired of playing the game Ain’t it a crying shame

-Lili Von Shtupp (Madeline Kahn) in “Blazing Saddles

One thing we can all agree on this political season is that everyone seems tired -- tired of the shouting, the rhetoric and the divisiveness. In some ways, the stock market also feels a bit tired right now, as investors continue to suffer from Fed fatigue. After enduring a correction early in the year, then charging to all-time highs over the summer, the rally seems to have lost some steam lately. Perhaps the slowdown is for good reason, at least from the consumer’s point of view: with the labor market tightening, US companies are paying higher wages, which eats into their profit margins and hurts stock performance. Most Americans would likely happily endure so-so mid-single digit returns from stocks in their retirement plans, in exchange for fatter paychecks.

Conversations about the Federal Reserve also seem a little wearing these days. The Fed’s impact on risk assets, like stocks, seems to wax and wane from week to week, with most now believing that the central bank will raise rates by a quarter of a percent at the mid-December meeting. By that time, investors will know the outcome of the election and will also have a bit more data to confirm that economic growth can withstand a Fed move. This week, the government will release one of the last few important reports before that meeting: third quarter Gross Domestic Product (GDP).

After a dreadful first half of the year, when the economy expanded by just about one percent, growth has accelerated in the second half of this year, as the effects of a stronger dollar and lower oil prices have started to fade. Economists expect that the first estimate of third quarter growth will rebound to an annualized rate of 2.5 percent, due in large part to a surge in exports and specifically soybean exports. Depending on how the Bureau of Economic Analysis handles the spike and then likely reversal in the subsequent quarter could impact the headline. When it’s all smoothed out, we should expect that growth for all of 2016 will be the same, tired 2 percent or so that we have seen over the past few years.

In addition to GDP, which will be revised in a month, the Fed will also chew on the following before the December FOMC: two employment reports (11/6 and 12/4), two Personal Income and Spending reports, which contain the Fed’s favorite measure of inflation, PCE Index (10/31 and 11/30) and one more Consumer Price Index report (11/17). Presuming that these reports are mostly in line with trends, the Fed should hike in December. After that, I'm afraid to tell you that we're likely to endure another round of exhaustive speculation about the pace of rate hikes…in other words, be prepared for the 2017 version of Fed fatigue.

- DJIA: 18,145, up 0.04% on week, up 4.1% YTD

- S&P 500: 2141, up 0.4% on week, up 4.8% YTD

- NASDAQ: 5257, up 0.8% on week, up 5% YTD

- Russell 2000: 1218, up 0.5% on week, up 7.2% YTD

- 10-Year Treasury yield: 1.74% (from 1.80% week ago)

- British Pound/USD: 1.2227 (from 1.2188 week ago)

- November Crude: $50.85, up 1% on week

- December Gold: $1,267.70, up 1% on week

- AAA Nat'l avg. for gallon of reg. gas: $2.23 (from $2.25 wk ago, $2.22 a year ago) Prices have climbed above their year-ago levels for the first time in over two years (7/13/14)

THE WEEK AHEAD:

Mon 10/24:

Visa

8:30 Chicago Fed National Activity Index

Tues 10/25:

Apple, AT&T, General Motors, Pandora

9:00 FHFA House Price Index

9:00 S&P Case-Shiller HPI

10:00 Consumer Confidence

Weds 10/26:

Coca-Cola, Groupon, Texas Instruments

10:00 New Home Housing Sales

Thursday 10/27:

Amgen, Deutsche Bank, Ford, Sirius XM

8:30 Durable Goods

10:00 Pending Home Sales

Friday 10/28:

Exxon Mobil, Hershey, MasterCard

8:30 Q3 GDP – 1st Estimate

8:30 Employment Cost Index

10:00 Consumer Sentiment

Economic Growing Pains

While it was no surprise that the Fed took no action at last week’s FOMC meeting, there was something interesting contained in the officials’ economic projections. The central bank lowered its longer run expected growth rate from 2 percent to 1.8 percent. This downward revision started in 2012, when the Fed expected growth to be 2.4 percent, which at the time, seemed a far cry from the average pre-crisis annual growth rate of about 3 percent. 1.8 percent seems pretty rotten, but to judge it more effectively, historic data can help. From 1985-2015, GDP averaged about 2.75 percent, but during the post-technology boom through last year (2001-2015), growth averaged…1.8 percent. This more recent slowdown is at the core of the argument among the economic wonks: The doom and gloomers (think former Treasury Secretary Larry Summers) say that the US economy is plagued by “secular stagnation,” where individuals and companies are not tempted to invest, savings’ pile up and growth slumps. Amid this environment, central banks try to nudge participants to do something with their cash by slashing interest rates and buying bonds, but over time, these policy measures lose their oomph.

The other side, led by former Fed Chair Ben Bernanke, argues that weaker economic growth is due to temporary cyclical and special factors and eventually the economy will revert back to its old ways. For the past year and a half, Bernanke has argued that the US economy is working its way out of this “cyclical stagnation,” proof of which can be seen in the improving labor market, and “the availability of profitable capital investments anywhere in the world should help defeat secular stagnation at home.”

Hindsight will determine which side is right, but the bottom line, according to Paul Ashworth at Capital Economics, “is that GDP growth has been disappointing.” The lowered Fed projections are simply an acknowledgement of what we have been experiencing on the ground. This week, the government will release the final estimate of second quarter growth, which is expected to edge up to a still-paltry 1.3 percent from the previous reading of 1.1 percent.

The lowered estimate of growth is good to remember, especially when Republican presidential candidate Donald Trump predicts that his tax cut plan will boost economic growth of 3.5 to 4 percent, more than two times what the Fed believes will occur and well-above the 2.75 percent seen from 1985-2015. Trump cited 4 percent growth last week, after doing so earlier this month. As a point of reference, the US economy has not seen 4 percent growth since the height of the dot-com bubble in 2000.

FAFSA UPDATE: The Free Application for Federal Student Aid form (“FAFSA”) is the gateway to education money and it is now available on October 1, three months earlier than in previous years. Given how expensive it is to attend college, here’s a mind blowing statistic from NerdWallet: High school graduates left $2.7 billion in FREE federal grant money on the table over the last academic year, because they did not complete the form…for more on this topic, check out: College Money for the Taking!

MARKETS:

- DJIA: 18,261, up 0.8% on week, up 4.8% YTD

- S&P 500: 2164, up 1.2% on week, up 5.9% YTD

- NASDAQ: 5305, up 1.2% on week, up 6% YTD

- Russell 2000: 1254, up 2.5% on week, up 10.5% YTD

- 10-Year Treasury yield: 1.62% (from 1.69% week ago)

- British Pound/USD: 1.2973

- November Crude: $44.48, up 2% on week

- December Gold: $1,341.70, up 2.4% on week

- AAA Nat'l avg. for gallon of reg. gas: $2.21 (from $2.19 wk ago, $2.29 a year ago)

THE WEEK AHEAD:

Mon 9/26:

10:00 New Home Sales

10:30 Dallas Fed Survey

Tues 9/27:

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

Weds 9/28:

8:30 Durable Goods Orders

Thursday 9/29:

8:30 GDP

9:00 Corporate Profits

10:00 Pending Home Sales Index

Friday 9/30:

8:30 Personal Income and Spending

9:45 Chicago PMI

10:00 Consumer Sentiment

Saturday 10/1

FAFSA Form Available (3 months earlier than in the past)

Snails’ Pace Growth to Keep Fed on Sidelines

There are now dueling economic growth forecasts by regional Fed banks. The Atlanta Fed’s GDPNow model forecast for Q1 GDP growth is 0.3 percent and the Federal Reserve Bank of New York’s recently unveiled Nowcast model anticipates that GDP will expand by 0.8 percent. Forgive us if we are not that interested in the half of a percentage point differential, because either way, we are talking about snail’s pace, sub-one percent growth.

In the seven years since the end of the recession (the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER) said the recession ended in June 2009), the expansion has been sluggish, averaging between 1.5 and 2.5 percent. While so-so growth is typical of recoveries that follow cataclysmic, near-death experiences like the financial crisis and the 18-month Great Recession, the reality is that progress has felt like one step forward, one step back.

It appears that Q1 will be one of the “one step back” periods--we will see when the government releases its first estimate of growth for January-March this week. The good news is that the report is already history and the current quarter could see a step forward. Analysts at Capital Economics “anticipate a rebound in the second-quarter and expect annual GDP growth will be slightly above 2 percent for 2016 as a whole, which would be broadly in line with the trend during this recovery.”

Although economic conditions are looking up, the data have not be strong enough to encourage the Fed to raise interest rates at its upcoming policy meeting this week. The central bankers will likely tell us about the improvement in financial conditions, stabilization of oil prices and diminishing fears over China’s economic outlook and its ripple effects on emerging market currencies, but none of that will prompt action. The big question, according to Capital Economics, “is whether the improvement in financial conditions and the slightly better global outlook persuades the FOMC to drop the language in the statement that ‘global economic and financial developments continue to pose risks’?” If the Fed opts to change its language, it could be preparing markets for a June increase, something investors are not yet anticipating.

MARKETS: Although earnings have fallen over the past year, results have not been as bad as feared and large stocks have been able to edge up. Both the Dow and S&P 500 are 2 percent or less below their 52-week intra-day highs.

- DJIA: 18,003 up 0.5% on week, up 3.3% YTD

- S&P 500: 2091 up 0.6% on week, up 2.3% YTD

- NASDAQ: 4906 down 0.7% on week, down 2% YTD

- Russell 2000: 1146, up 1.4% on week, up 1% YTD

- 10-Year Treasury yield: 1.9% (from 1.75% a week ago)

- June Crude: $43.73, up 4.8% on week (up 67% from Feb lows)

- June Gold: $1,230, down 0.4% on week

- AAA Nat'l avg. for gallon of reg. gas: $2.13 (from $2.11 wk ago, $2.49 a year ago)

THE WEEK AHEAD:

Mon 4/25:

Haliburton

10:00 New Home Sales

Tues 4/26:

3M, Apple, Chipotle, Twitter

FOMC Policy Meeting Begins

8:30 Durable Goods Orders

9:00 S&P Case Shiller Home Price Index

10:00 Consumer Confidence

Weds 4/27:

Boeing, Facebook

10:0O Pending Home Sales Index

2:00 pm FOMC Meeting Announcement

Thursday 4/28:

LinkedIn, Amazon, UPS, Ford, MasterCard, Conoco Phillips

8:30 Q1 GDP – 1st estimate

Friday 4/29:

Chevron, Exxon Mobil

8:30 Personal Income and Spending

8:30 Employment Cost Index

9:45 Chicago PMI

10:00 Consumer Sentiment

Is the US Economy at Full Employment?

Full employment is often described as the level of employment at which virtually anyone who wants to work can find employment at the prevailing wage. Given that over the last half century, the unemployment rate in the United States has ranged from a low of nearly 2 percent to a high of nearly 11 percent, what is the specific rate at which the economy has reached the magical level? According to the Federal Reserve, full employment is subjective. It’s “largely determined by nonmonetary factors that affect the structure and dynamics of the job market. These factors may change over time and may not be directly measurable.” In other words, your guess is as good as anyone else’s. In the Fed's March 2016 Summary of Economic Projections, the Committee estimated that the longer-run normal rate had a median value of 4.8 percent, but even if we drop to 4.8 percent when the government releases the March Employment report, that may not cut it.

The Fed also closely watches wage growth and hoping that it picks up from the paltry 2 to 2.5 percent seen during the recovery. Part of the problem is that even though job creation has been robust over the past few years, many of the new positions added have been lower paid ones, which has dragged down the average. As 538 Blog points out, this is perhaps why many American workers without college degrees are so angry. They have gone from working in factories, earning “more than $25 an hour before overtime” to the service sector, where “the typical retail worker makes less than $18 an hour…More than 80 percent of all private jobs are now in the service sector.”

Still, with the pace of average monthly job gains remaining above 200,000 and the labor market tightening, analysts believe that wage growth should accelerate this year. Until it does, most consumers are happy to see low inflation, which allows them to keep more of their paychecks. Indeed, the upward revision of Q4 growth to a still-slow 1.4 percent was due almost entirely from consumers, not from businesses. Consumer spending increased at a 2.4 percent annual pace in the final three months of 2015, up from a prior 2 percent estimate.

On Monday, the government will release data on Personal Income and Spending for March, which could provide a preview of the jobs report. Although wages have been disappointing, the addition of other income, like rental income, non-farm proprietors' income and investment income, the numbers look a little better: Personal income increased 4.4 percent in 2015.

MARKETS: Stock indexes snapped a five-week winning streak and that was before the holiday release of Corporate Profits, which fell 3.2 percent last year, versus increases of 1.7, 1.9 and 9.1 percent in 2014, 2013 and 2012 respectively. It was the first negative reading since 2008, but with energy prices moderating and dollar appreciation slowing, analysts expect that profits should rise this year, which could help the labor market.

- DJIA: 17,516 down 0.5% on week, up 0.5% YTD

- S&P 500: 2036 down 0.7% on week, down 0.4% YTD

- NASDAQ: 4773 down 0.5% on week, down 4.7% YTD

- Russell 2000: 1101, down 1.3% on week, down 3% YTD

- 10-Year Treasury yield: 1.90% (from 1.88% a week ago)

- May Crude: $39.59, down 2.4% on week

- June Gold: $1,218.70, down 2.6% on week

- AAA Nat'l avg. for gallon of reg. gas: $2.04 (from $1.98 wk ago, $2.42 a year ago)

THE WEEK AHEAD:

Mon 3/28:

8:30 Personal Income and Spending

10:00 Pending Home Sales

10:30 Dallas Fed Manufacturing Survey

Tues 3/29:

9:00 S&P Case Shiller Home Price Index

10:00 Consumer Confidence

Weds 3/30:

8:15 ADP Private Jobs Report

Thursday 3/31:

9:45 Chicago PMI

Friday 4/1

Motor Vehicle Sales

8:30 March Employment Report

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Consumer Sentiment

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)