Hurricanes Irma and Harvey blew across the labor market, as employers shed 33,000 jobs in September. Yes, it was the first negative reading on payrolls in seven years, but until we have the subsequent few months’ reports, it’s hard to read too much into the results. (As a note, Puerto Rico is NOT included in the BLS report.) The Labor Department said that the storms likely contributed to “a sharp employment decline in food services and drinking places (-105K) and below-trend growth in some other industries.”

Will Weak Jobs Put Rate Hikes at Risk?

With the labor market slowing down, will the Federal Reserve raise interest rates at its next policy meeting in two weeks? That was the big question after the Labor Department reported that the economy added a disappointing 138,000 jobs in May, worse than the 185,000 analysts had expected. Additionally, the previous two months were revised lower by 66,000, putting the three month average at just 121,000. In the first five months of 2017, the economy has seen average monthly job creation of 162,000, down from 189,000 in 2016, and 226,000 in 2015.

Trump Tax Tease

President Trump’s “new” tax plan looked an awful lot like his old one from the campaign, though with far fewer details. The one-page overview was more like an incomplete set of bullet points, than a blueprint. For example, the plan would reduce the number of tax brackets from seven to three - 10, 25 and 35 percent, but there was no breakdown of income levels to which the new rates would apply. It also intends to provide a break for child and dependent care expenses, but did not specify the dollar amount.

Stormy Weather for March Jobs

Although it may seem like a lame excuse, stormy weather in March, which followed mild conditions in February, caused job creation to slump in March. The economy added a lower than expected 98,000 jobs and the number of Americans who were not at work due to bad weather was 195,000 in this report, 55,000 more than the historic number of 140,000. Adding back those employees, the reading was 153,000, somewhat weaker than the 175,000 expected, but well within the general range.

Retirement Planning Week 2017

Happy Retirement Planning Week! In honor of the celebration, it’s time to take stock of where Americans stand. According to the 2017 Employee Benefit Research Institute (EBRI) Retirement Confidence Survey, we still have some work to do:

Strong Feb Jobs Means Fed Rate Hike

Get ready for a Fed interest rate hike this week. The February jobs report showed that the US economy added a larger than expected 235,000 jobs, the unemployment rate edged down to 4.7 percent and annual wage growth bounced back from a revised 2.6 percent in January to 2.8 percent, ahead of the 2.7 percent average seen in the second half of last year. The increase in wages demonstrates that the labor market is tightening and that state-level minimum wage hikes are filtering through the economy.

Bull Market Celebrates Eight on a High

As the bull market in US stocks gets set to celebrate its eighth birthday this week, it is stunning to consider how far we have come. On March 9, 2009, here was the closing level of the three major indexes:

- Dow: 6547 – lowest level since April 15, 1997

- S&P 500: 676 – lowest level since Sept 12, 1996

- NASDAQ: 1268 – lowest level since Oct 9, 2002

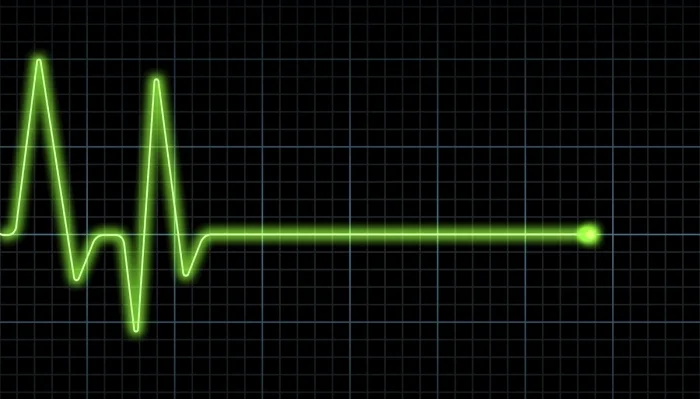

DOL Fiduciary on Life Support

The Department of Labor's fiduciary rule faces two hurdles: a lawsuit and now, the Trump Administration's efforts to delay or perhaps kill it off. On Friday, President Trump signed an order directing the Treasury secretary to review the 2010 Dodd-Frank financial regulatory law. You remember Dodd-Frank, the big legislation meant to reign in the excesses of Wall Street after the financial crisis, right?

The Obama Economic Legacy

As President Obama leaves office, it’s time to reflect on how the economy fared during his tenure. Because of the size and complexity of the U.S. economy, I have generally believed that presidents take too much credit or blame for what occurs on their watch. In many cases, bad luck or good fortune can play a larger role in a particular president’s economic performance than actual policy.

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)