One result of the pandemic has been historically low interest rates. How low can they go? Will they go negative? If so, what would that mean?

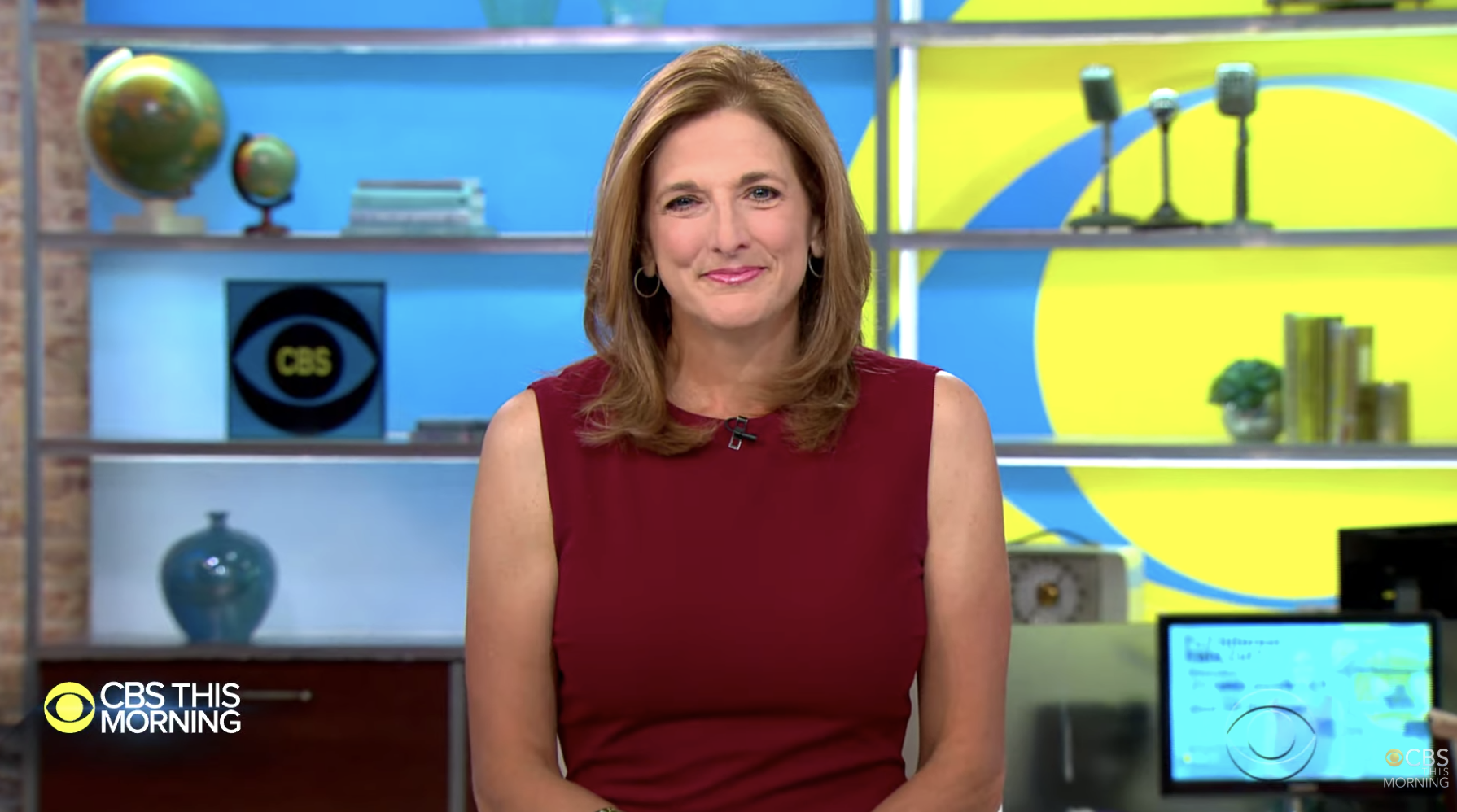

Have a money question? Email me here.

Please leave us a rating or review in Apple Podcasts.

"Jill on Money" theme music is by Joel Goodman, www.joelgoodman.com.

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)