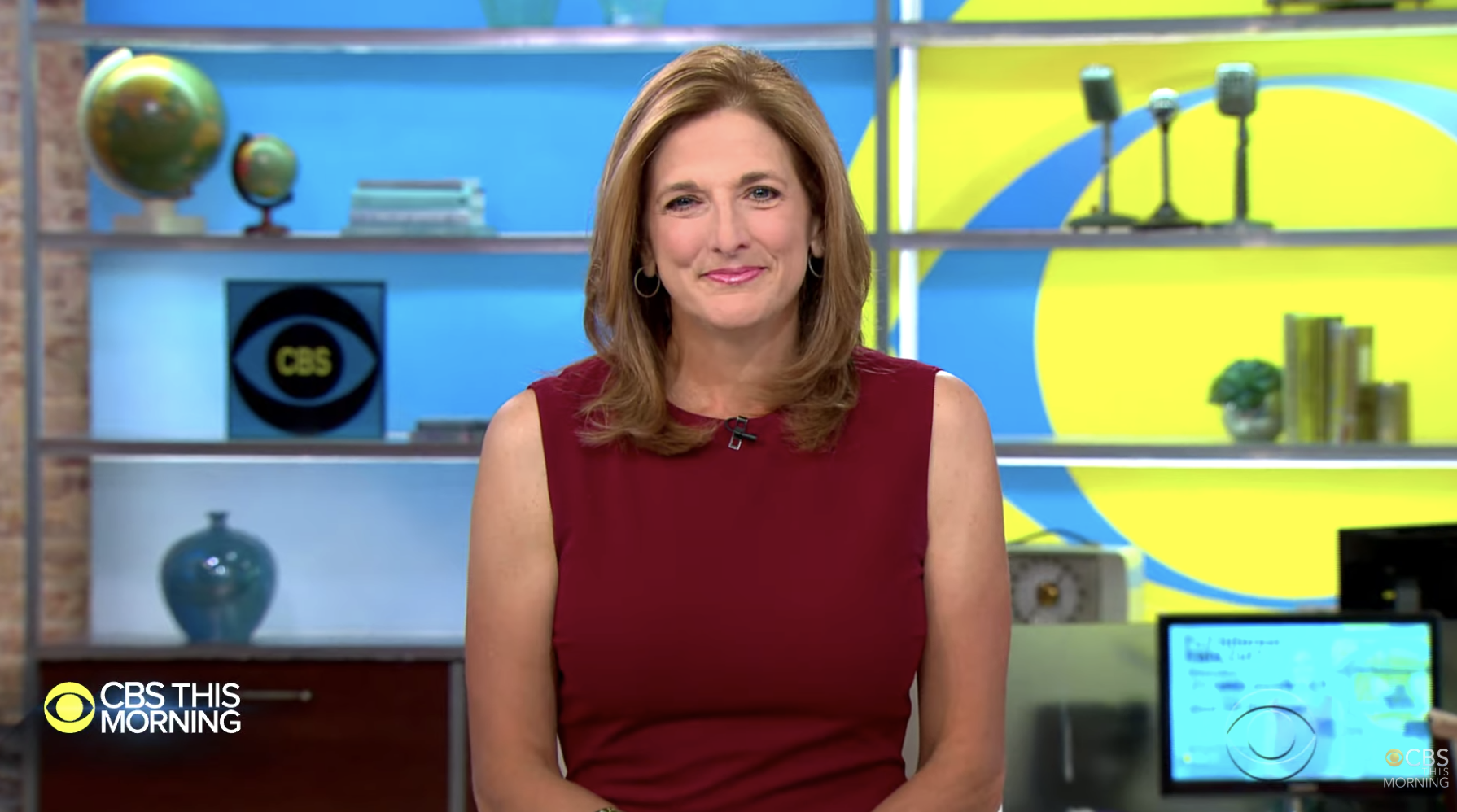

I joined CBS Mornings to discuss the news out of the latest Federal Reserve meeting, including how inflation is impacting the Fed's decision to pull back on the emergency policies it put in place during the pandemic and how likely interest rate hikes next year will impact consumers.

Bungee Cord Economy: Will YOUR Finances Snap Back?

Covid-19 has wreaked havoc across the world. What started as a health pandemic quickly became a financial pandemic and now the two are intertwined. What does that mean for the second half of the year? And more importantly, how should you prepare for another six months living amid the dual threat of a health and financial pandemic?

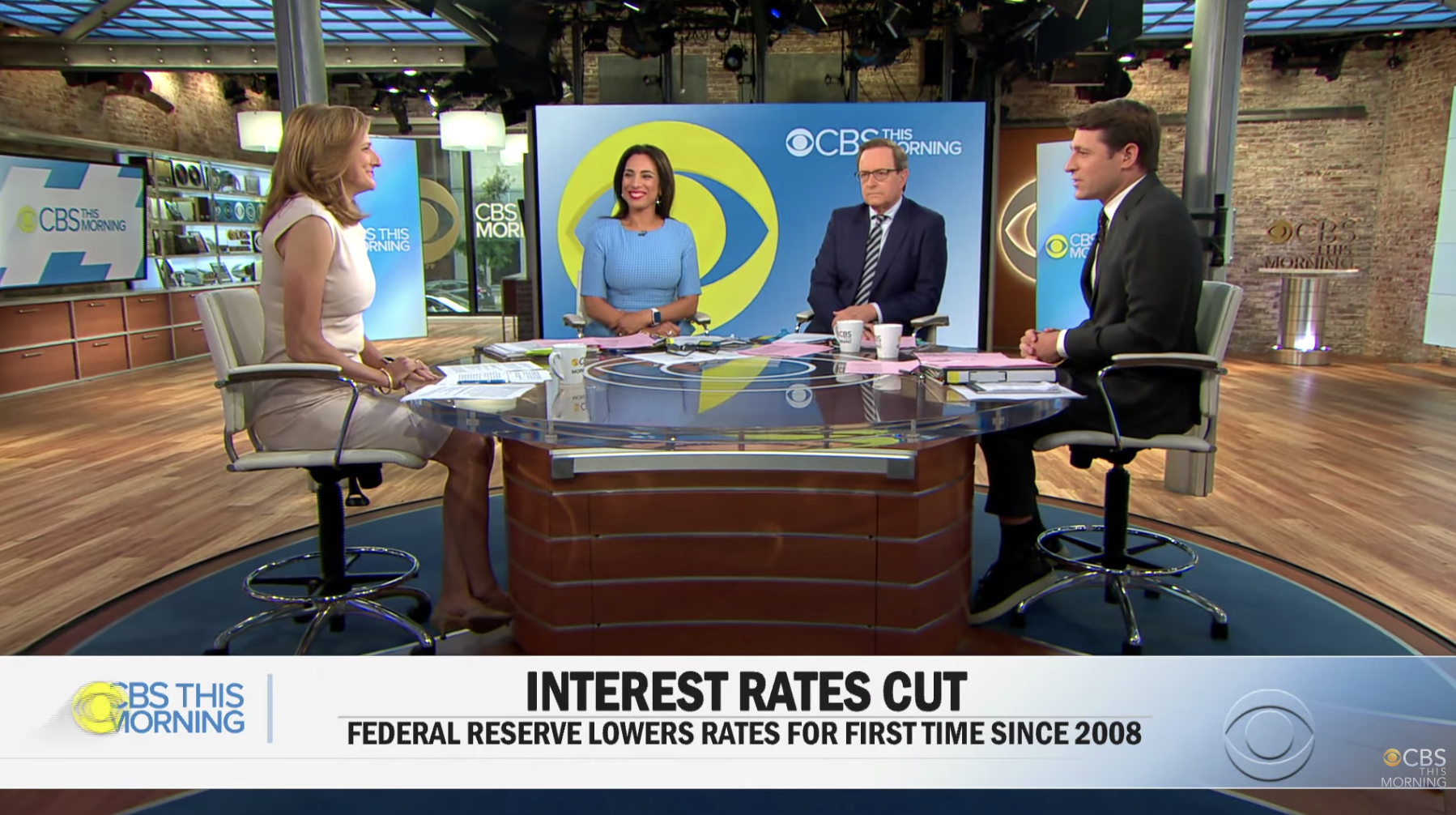

CBS This Morning: Interest Rate Cut

Federal Reserve Bank leaders, working to prevent an economic slowdown, begin two days of meetings on Tuesday. Economists predict they will announce an interest rate cut of 25 basis points, or a quarter of a percent. It would be the second cut this year. I joined CBS This Morning to discuss how this could affect your bottom line.

Will the Fed Follow the ECB?

Last week, the European Central Bank cut its benchmark interest rate to a record low of -0.5 percent. That’s right, MINUS! Big commercial banks now have to pay the ECB a little bit more for the privilege of keeping money in reserve.

CBS This Morning: Impact of Rate Cut

The cost of borrowing is coming down. For the first time since the 2008 financial crisis, the Federal Reserve cut interest rates. The central bank lowered the benchmark federal funds rate by a quarter percentage point Wednesday. The decision could make it easier for consumers to borrow money, on everything from credit cards to car loans. I joined CBS This Morning with a look at what the decision means for your wallet.

CBS Evening News: Interest Rate Cut

The cost of borrowing is going down, but so is the return on savings, after the Federal Reserve cut a key interest rate. I joined the CBS Evening News to explain how it will impact Americans.

How Fed Rate Cuts Impact YOU

For the first time in a decade, the Federal Reserve is likely to cut interest rates. Citing the “crosscurrents” of slowing global growth, uncertainty over trade policy, and static prices, the central bank will preemptively shave 0.25 percent from the fed funds rate, putting the new range at 2-2.25 percent.

Financial Independence

Inside the Fed’s Head

Amid renewed Presidential criticism and evidence of a slowing economy, Fed officials will convene a two-day policy meeting this week and the pressure is on. As always, central bankers have to balance maintaining a strong enough economy to foster job growth, but it can’t run too hot, which might trigger inflation. Right now, there’s a battle brewing inside the collective Fed’s Head between action and inaction.

Meh May Jobs Report and the Powell Put

Stocks reversed multi-week losses and you can thank Federal Reserve Chairman Jerome Powell. The week began with hand wringing over the potential Mexican tariffs. On Tuesday, Powell announced that the central bank was keeping an eye on trade developments, their impact on the U.S. economy, and would “act as appropriate to sustain the expansion.”

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)