Are we making a mistake by directing all our retirement contributions into the Roth option?

Have a money question? Email us, ask jill [at] jill on money dot com.

Are we making a mistake by directing all our retirement contributions into the Roth option?

Have a money question? Email us, ask jill [at] jill on money dot com.

Preparing for retirement is the name of the game, but there's more to life than just saving, at some point you have to enjoy things along the way.

Have a money question? Email us, ask jill [at] jill on money dot com.a

Please leave us a rating or review in Apple Podcasts.

"Jill on Money" theme music is by Joel Goodman, www.joelgoodman.com.

Most people nowadays have an old retirement account out there from a previous employer. What should you do with it? Leave it where it is? Roll it over into the new plan? Put it into a rollover IRA? That was the discussion as we kicked things off with Nate from Texas.

Sticking with retirement plans, when does it make sense to starting converting a traditional IRA into a Roth IRA? That’s what Steve from Minnesota wanted to discuss.

When fast-scaling startups and global organizations get stuck, they call our guest in hour two, Aaron Dignan.

In his recently released book, Brave New Work: Are You Ready to Reinvent Your Organization?, he reveals his proven approach for eliminating red tape, dissolving bureaucracy, and doing the best work of your life.

He’s found that nearly everyone, from Wall Street to Silicon Valley, points to the same frustrations: lack of trust, bottlenecks in decision making, siloed functions and teams, meeting and email overload, tiresome budgeting, short-term thinking, and more.

Is there any hope for a solution? Haven’t countless business gurus promised the answer, yet changed almost nothing about the way we work?

That’s because we fail to recognize that organizations aren’t machines to be predicted and controlled. They’re complex human systems full of potential waiting to be released.

Dignan says you can’t fix a team, department, or organization by tinkering around the edges. Over the years, he has helped his clients completely reinvent their operating systems, the fundamental principles and practices that shape their culture, with extraordinary success.

In Brave New Work you’ll learn exactly how organizations are inventing a smarter, healthier, and more effective way to work. Not through top down mandates, but through a groundswell of autonomy, trust, and transparency.

Have a money question? Email me here.

Please leave us a rating or review in Apple Podcasts.

Connect with me at these places for all my content:

https://www.jillonmoney.com/

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.youtube.com/c/JillSchlesinger

https://www.linkedin.com/in/jillonmoney/

https://www.stitcher.com/podcast/jill-on-money

https://apple.co/2pmVi50

"Jill on Money" theme music is by Joel Goodman, www.joelgoodman.com.

As more employers incorporate Roth options into work-based retirement accounts, many of you have written to ask which one is preferable. As always, the answer depends on your situation. The big difference between a traditional retirement option and a Roth is about when you pay taxes. With a traditional option, you pay in the future and with a Roth, you pay today.

We start the show this week with Shirley from D.C. who’s wondering if she should be using the Roth 401(k) that’s available to her. Most large companies nowadays offer the Roth option, the problem is that many employees aren’t familiar with what it is or how it works.

Next up was Laura from Seattle who has one main question: is our financial picture solid and sound? Sounds simple, but you guys know there’s a lot more to it than that.

Since 1973, our productivity has grown almost six times faster than our wages. Most of us rank so far below the top earners in the country that the "winners" might as well inhabit another planet.

But work is about much more than earning a living. Work gives us our identity, and a sense of purpose and place in this world. And yet, work as we know it is under siege.

Joining us today to discuss is Ellen Ruppel Shell, author of The Job: Work and Its Future in a Time of Radical Change.

Through exhaustive reporting and keen analysis, The Job reveals the startling truths and unveils the pervasive myths that have colored our thinking on one of the most urgent issues of our day: how to build good work in a globalized and digitalized world where middle class jobs seem to be slipping away.

Traveling from deep in Appalachia to the heart of the Midwestern rust belt, from a struggling custom clothing maker in Massachusetts to a thriving co-working center in Minnesota, Shell presents evidence from a wide range of disciplines to show how our educational system, our politics, and our very sense of self have been held captive to and distorted by outdated notions of what it means to get and keep a good job.

Work, in all its richness, complexity, rewards and pain, is essential for people to flourish. Ellen Ruppel Shell paints a compelling portrait of where we stand today, and points to a promising and hopeful way forward.

Have a money question? Email me here.

Please leave us a rating or review in Apple Podcasts.

Connect with me at these places for all my content:

https://www.jillonmoney.com/

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.youtube.com/c/JillSchlesinger

https://www.linkedin.com/in/jillonmoney/

https://www.stitcher.com/podcast/jill-on-money

https://apple.co/2pmVi50

"Jill on Money" theme music is by Joel Goodman, www.joelgoodman.com.

When you leave a job, odds are you're going to have an old retirement plan out there. What should you do with it? You can usually leave it where it is, or roll it over into a traditional IRA, or, if the dollars are pre-tax contributions, consider converting it to a Roth IRA. That's the discussion on the latest call with Matt from Maryland.

Have a money question? Email us here.

We love feedback so please subscribe and leave us a rating or review in Apple Podcasts!

Connect with me at these places for all my content:

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.linkedin.com/in/jillonmoney/

Let’s be honest...nobody likes paying Uncle Sam. I mean come on, who really wants to pay a big, fat tax bill?

That’s why you always hear me preaching about the power of Roth accounts. In a perfect world, we’d all be able to find a way into the 0% tax bracket.

While that’s unlikely, there are people out there trying to make it possible.

Today’s guest, David McKnight, has long warned that taxes in the future are likely to be dramatically higher than they are today. Given that, we need to dramatically change the way we approach retirement.

In his latest book, The Power of Zero: How to Get to the 0% Tax Bracket and Transform Your Retirement, McKnight aims to provides you with a road map of how to get to the 0% tax bracket, virtually eliminating the tax risk, which, if not addressed, will easily consume a solid portion of your retirement savings.

Unfortunately, if you’re like most Americans, you’ve saved the majority of your retirement assets in tax-deferred vehicles like 401(k)s and IRAs. If tax rates go up, how much of your hard-earned money will you really get to keep?

In The Power of Zero, David McKnight provides you with a step by step roadmap on how you can get to the 0% tax bracket, effectively eliminating tax rate risk from your retirement picture.

Why is the 0% tax bracket so powerful? Because if tax rates double, two times zero is still zero! The day of reckoning could be fast approaching. Are you ready to do what it takes to experience the power of zero?

Have a money question? Email us here.

We love feedback so please subscribe and leave us a rating or review in Apple Podcasts!

Connect with me at these places for all my content:

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.linkedin.com/in/jillonmoney/

Okay, it’s time for a BIG announcement. My very first book, The Dumb Things Smart People Do with Their Money, is now available for pre-order!!

Do you have a “friend” who is super smart, has a great career, holds a graduate degree, has even saved a chunk of money for retirement, but who keeps making the same dumb mistakes when it comes to money? Is this “friend” you?

The book reveals thirteen costly mistakes you’re probably making right now with your money without even knowing it. Drawing on heartfelt personal stories (yes, money experts screw up, too), I argue that it’s not lack of smarts that causes even the brightest, most accomplished people among us to behave like financial dumb-asses, but simple emotional blind spots.

Click here for all the info on how and where to place your order. Thank you for the support!!

Now on to the latest radio show where we kicked things off with Virginia from Buffalo who is trying to solve a good problem. When is it time to stop contributing to her IRAs? Is there such a thing as having too much saved?

At a time when Congress can’t seem to agree on much, lawmakers are acknowledging that the main retirement savings vehicle, the 401(k), needs some fixing. Before you get too excited, the changes being considered are more like touch ups, rather than a complete renovation.

Early conversations include: requiring plan sponsors to let participants know how much their total savings would translate into monthly income; a repeal of the age limit on IRA contributions; a more liberal approach to pooled 401(k) plans, which would help more small businesses offer retirement benefits to their employees; and the option to use a portion of a tax refund to fund retirement.

While none of these ideas represents a game-changer for retirement savers, it would be the first major enhancement since 2006. But if lawmakers wanted to seek a more radical approach, they would consult with Teresa Ghilarducci and Tony James, co-authors of Rescuing Retirement: A Plan to Guarantee Retirement Security for All Americans, who claim that "The U.S. experiment with 401(k)s and IRAs, launched in the early 1980s, has failed miserably to deliver on its promises."

Ghilarducci, a labor economist and leading expert in retirement security, and James, Executive Vice Chairman of the investment firm Blackstone Group, have a detailed, well-researched and more extreme recommendation for rescuing the U.S. retirement system. It starts with a concept called a “Guaranteed Retirement Account” (“GRA”), which would be offered to every worker, "from Uber drivers to CEOs."

The GRA would be portable, whether you work for a number of different companies or for yourself – and each individual would control his or her account. It would be funded by a minimum 3 percent of salary, half contributed by the worker and half by the employer.

Perhaps the most interesting part of the GRA is that it fixes some of the big problems that are prevalent in current plans, the biggest of which is that right now, saving for retirement is voluntary. The GRA would mandate retirement savings for everyone, including those who work part-time or are self-employed.

If it all sounds too good to be true, I encourage you to check out the book. I was a cynic, but after reading it and interviewing Ghilarducci and James, I’m a convert.

Have a money question? Email me here.

Connect with me at these places for all my content:

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.linkedin.com/in/jillonmoney/

http://www.stitcher.com/podcast/jill-...

"Jill on Money" theme music is by Joel Goodman, www.joelgoodman.com.

We're kicking things off this weekend with Susan from Chicago who is in the process of reevaluating her 401(k) and is wondering which target date fund she should be using? Should she even be using a target date fund? Or are there better alternatives?

Next up was Katrina from Alabama who is trying to game plan for retirement. Up until now almost everything has been saved in traditional 401(k) plans...should she and her husband start using the Roth feature?

The robots are coming, the robots are coming!!

Okay, so maybe we’re not yet living in a world that looks like the movie Terminator, but it’s safe to say that changes are coming to the workforce as we know it. Robots, artificial intelligence, and driverless cars are no longer things of the distant future. They are with us today and will become increasingly common in coming years, along with virtual reality and digital personal assistants.

That’s what we’re talking about today with Darrell West, a decades-long connection of mine who is vice president and director of Governance Studies and the founding director of the Center for Technology Innovation at the Brookings Institution. In his latest book, The Future of Work: Robots, AI, and Automation, West explores the current state of the workplace, how technological innovation will disrupt it and why government policy needs to change to help workers adapt to it.

If companies need fewer workers due to automation and robotics, what happens to those who once held those jobs and don't have the skills for new jobs? And since many benefits are delivered through employers, how are people outside the workforce for a lengthy period of time going to earn a living and get health care and social benefits?

Throughout the pages of this book, West argues that society needs to rethink the concept of jobs, reconfigure the social contract, move toward a system of lifetime learning, and develop a new kind of politics that can deal with economic dislocations.

West presents a number of proposals to help people deal with the transition from an industrial to a digital economy:

It’s a fascinating read about what faces us in the days ahead...a discussion that should take place sooner rather than later.

Have a money question? Email me here.

Connect with me at these places for all my content:

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.linkedin.com/in/jillonmoney/

http://www.stitcher.com/podcast/jill-...

"Jill on Money" theme music is by Joel Goodman, www.joelgoodman.com.

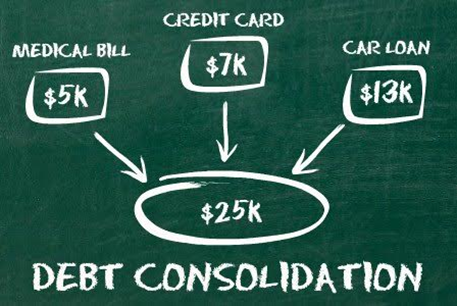

Should I refinance my student loans? Is debt consolidation the best option? Should I be using a Roth IRA? Those are the latest questions we answered as we attempt to clear out the inbox!

“Better Off” is sponsored by Betterment.

Have a money question? Email me here or call 855-411-JILL.

We love feedback so please subscribe and leave us a rating or review in Apple Podcasts!

Connect with me at these places for all my content:

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.linkedin.com/in/jillonmoney/