Hurricanes Irma and Harvey blew across the labor market, as employers shed 33,000 jobs in September. Yes, it was the first negative reading on payrolls in seven years, but until we have the subsequent few months’ reports, it’s hard to read too much into the results. (As a note, Puerto Rico is NOT included in the BLS report.) The Labor Department said that the storms likely contributed to “a sharp employment decline in food services and drinking places (-105K) and below-trend growth in some other industries.”

June Jobs Take Off: Stocks Surge

The better than expected June jobs report was a much-needed shot in the arm for the recently sagging labor market. The economy added 287,000 jobs, including the return of about 30,000 striking Verizon workers, and the unemployment rate rose to 4.9 percent, but did so for a good reason: more people entered the labor force in search of work. Along with a terrible May (revised down to just +11,000 jobs, the weakest month of hiring since the job recovery began in 2010) and a mediocre April (revised up to +144,000), June’s numbers brought second-quarter average monthly job creation to 147,000 – that’s down from 196,000 in the first quarter, 229,000 last year and 260,000 in 2014. The big question now: is the recent trend portending weakness in the economy or is it a natural slowdown, as we begin the eighth year of the recovery?

Other parts of the report complicate the answer. The broad measure of unemployment U-6), fell to 9.6 percent, down 0.9 percent from a year ago, but more than a percentage point above its pre-recession level. Meanwhile, hourly pay increased by 2.6 percent from a year ago, matching the highest level of the recovery.

My guess is that the labor market is tightening and that something weird occurred in May. That said, more data is necessary to determine the direction of the labor market, which also means that the Fed is unlikely to take any action at its policy meeting at the end of this month.

Next question: Would a strong summer hiring season encourage the Fed to consider an increase at the September meeting? Maybe, but European politics may again force a delay in the Fed’s rate hike cycle. If you liked “Brexit,” you’re going to love “Quitaly”. In October, Italians will head to the polls to vote on whether to oust the current prime minister, potentially leading to a general election in which the anti-European Five Star Movement could gain ground and advance their call for Italy to withdraw its membership of the euro, though the party supports EU membership. As the vote nears, Italy is once again confronting the possibility of bailing out the world’s largest bank, Monte dei Paschi, which continues to hold nearly $400 billion of non-performing loans on its books, by far the largest in the EU.

According to Capital Economics, a survey in May “showed that 58 percent of Italians wanted a referendum on their EU membership. Granted, only 48 percent said that they would vote to leave. But the final UK opinion poll last week also suggested that only 48 percent would vote to leave the EU.” In other words, add you should probably add “Quitaly” to your summer lexicon.

MARKETS: Last week, the yield on the 10-year U.S. Treasury note touched a record low of 1.321 percent and the 30-year also checked in with its own record low of 2.098 percent. Yes, that means that if you lend the US government money for THIRTY years, you would receive a paltry 2.1 percent in interest. Meanwhile, stock indexes charged higher on the week, nearing all time highs reached in May 2015. As earnings season begins this week, investors will have to reconcile current prices with a likely fifth straight year-over-year quarterly profit decline.

- DJIA: 18,146, up 1.1% on week, up 4.1% YTD, now above pre-Brexit level (18,011)

- S&P 500: 2130, up 1.3% on week, up 4.2% YTD, 1 point below 05-15 record high

- NASDAQ: 4956, up 2% on week, down 1% YTD

- Russell 2000: 1177, up 2.2% on week, up 3.6% YTD

- 10-Year Treasury yield: 1.366%, a record low close (from 1.45% a week ago)

- British Pound/USD: $1.295, a 31-year low

- August Crude: $45.41, down 7.3% on week, largest percentage loss since Feb

- August Gold: at $1,358.40, up 1.5% on week

- AAA Nat'l avg. for gallon of reg. gas: $2.25 (from $2.28 wk ago, $2.76 a year ago)

THE WEEK AHEAD:

Mon 7/11:

Alcoa

10:00 Labor Market Conditions

Tues 7/12:

6:00 NFIB Small Biz Optimism Index

10:00 Job Openings and Labor Market Turnover

Weds 7/13:

8:30 Import/Export Prices

2:00 Fed Beige Book

2:00 Treasury Budget

Thursday 7/14:

BlackRock, JPMorgan Chase, Yum! Brands

The Bank of England interest rate decision (the first post-Brexit announcement)

8:30 PPI-FD

Friday 7/15:

Citigroup, U.S. Bancorp, Wells Fargo

8:30 CPI

8:30 Retail Sales

9:15 Industrial Production

10:00 Business Inventories

10:00 Consumer Sentiment

Solid Jobs Report = Fed Rate Hike

The government said that the U.S. economy added 211,000 jobs in November, which was the high-end of the predicted range of 160,000-220,000. There is now little doubt that the Federal Reserve will raise short-term interest rates when it meets in a week and a half. The three-month average of job creation stands at a solid 218,000 and year-over-year, 2.64 million jobs were added. Although 2015 average monthly job creation of 210,000 is less than last year’s strong pace of 260,000, it has certainly been strong enough to push down the unemployment rate from 5.8 percent a year ago, to a seven-year low of 5 percent. The broader measure of unemployment, which includes those who have stopped looking as well as those working part-time for economic reasons, edged up slightly to 9.9 percent, though remained under the key 10 percent level for a second consecutive month.

The Fed is also likely to be encouraged by the breadth of job gains, including the domestic-focused construction, retail and health care sectors. That said, two areas that continue to be under pressure are mining and manufacturing, both of which have been struggling under the triple whammy of lower oil prices, weak demand overseas and a stronger U.S. dollar. Another area of weakness is the still low level of working-age Americans who have jobs or are actively looking for work. The participation rate edged up to 62.5 percent, due to a 273,000 increase in the labor force, but because of demographics and the large number of would-be workers giving up their job searches, participation remains near 40-year lows.

Back to the good news...after a swift 2.5 percent annual increase in October, wages in November were up a still-respectable 2.3 percent from a year ago. In a separate report released by the government earlier last week, Q3 hourly compensation jumped by 4 percent in the third quarter, on an annualized basis and was up 3.6 percent compared to the same quarter a year ago. If that trend holds, hourly compensation is on track to rise by the largest amount since 2007 and when adjusted for inflation, the increase would be the fastest since 2000.

Overall, the results confirm that the economy continues to expand; the labor market is improving and workers are gaining leverage; and the Fed will soon hike interest rates for the first time in over nine years.

MARKETS: The US jobs report, along with promises of “no limit” on additional ECB stimulus measures, was enough to save what was shaping up to be a losing week.

- DJIA: 17,847 up 0.3% on week, up 0.1% YTD

- S&P 500: 2,091 up 0.01% on week, up 1.6% YTD

- NASDAQ: 5,142 up 0.3% on week, up 8.6% YTD

- Russell 2000: 1183, down 1.6% on week, down 1.8% YTD

- 10-Year Treasury yield: 2.28% (from 2.22% a week ago)

- Jan Crude: $39.97, down 4.2% on week

- Feb Gold: $1,084.10, up 2.6% on week

- AAA Nat'l avg. for gallon of reg. gas: $2.05 (from $2.09 wk ago, $2.79 a year ago)

THE WEEK AHEAD: December 9th marks the 50th anniversary of the debut of “A Charlie Brown Christmas”. The image of the sad little Christmas tree that Charlie and Linus selected may be a good symbol of the U.S. economy. At first glance, it seems a little thin and wobbly, but upon further reflection, it’s not “such a bad little tree. It's not bad at all, really. Maybe it just needs a little love.”

Mon 12/7:

Tues 12/8:

6:00 NFIB Small Business Optimism

10:00 Job Openings and Labor Turnover (JOLTS)

Weds 12/9:

Thursday 12/10:

8:30 Import/Export Prices

Friday 12/11:

8:30 Retail Sales

8:30 PPI

10:00 Business Inventories

10:00 Consumer Sentiment

March Jobs Report: Good, Not Great

After disappointing, weather-related readings over the past few months, the Labor Department said the economy added 192,000 non-farm jobs in March, a return to the pre-polar-vortex trend. Revisions to the previous two months amounted to an additional 37,000 jobs. The unemployment rate remained at 6.7 percent, which is basically where it has been for the past four months. This good, not great report brings us back to where we were before the severe winter and also helped the economy reach a milestone: private employment has returned to the pre-recession peak and is now at an all time high. However total payroll employment is still 437,000 positions below the pre-recession peak due to government layoffs. Given the current pace of job creation, total employment should reach a new high sometime this summer - a full five years AFTER the recession officially ended. Even that milestone might be a little empty, because we are shooting to go above the December 2007 levels to account for the additional 2 million people who have entered the labor since then.

There is also a big concern that many of the jobs being created are low wage positions. Earlier in the week, the Labor Department released a less talked about analysis of the types of jobs that Americans hold and the wages associated with those jobs. Retail salespeople and cashiers are the nation’s two largest occupations with 4.5 million and 3.3 million respectively, with an average pay of $12.20 and $9.82 per hour respectively. That’s well below the mean for all occupations, which is $22.33/hour or over $46,000 annually.

According to the Wall Street Journal, “During the recession, 60% of job losses occurred in middle-wage occupations paying between $13.83 and $21.13 per hour, while 21% of losses involved jobs paying less than $13.83 hourly. During the recovery, however, only 22% of new jobs paid middle wages while fully 58% were at the lower-wage end of the scale. In other words, millions of re-employed workers have experienced downward mobility.”

In fact, of the 10 largest occupations (retail salespersons, cashiers, food preparation and serving workers, general office clerks, registered nurses, waiters and waitresses; and customer service representatives), which accounted for 21 percent of total employment last year, only registered nurses, who earn about $69,000 had an average wage above the mean. The large numbers of low wage positions also explains why are up only 2.1 percent from a year ago. When adjusted for inflation that is a less than 1 percent rise, which may be part of the reason that the recovery has been sluggish.

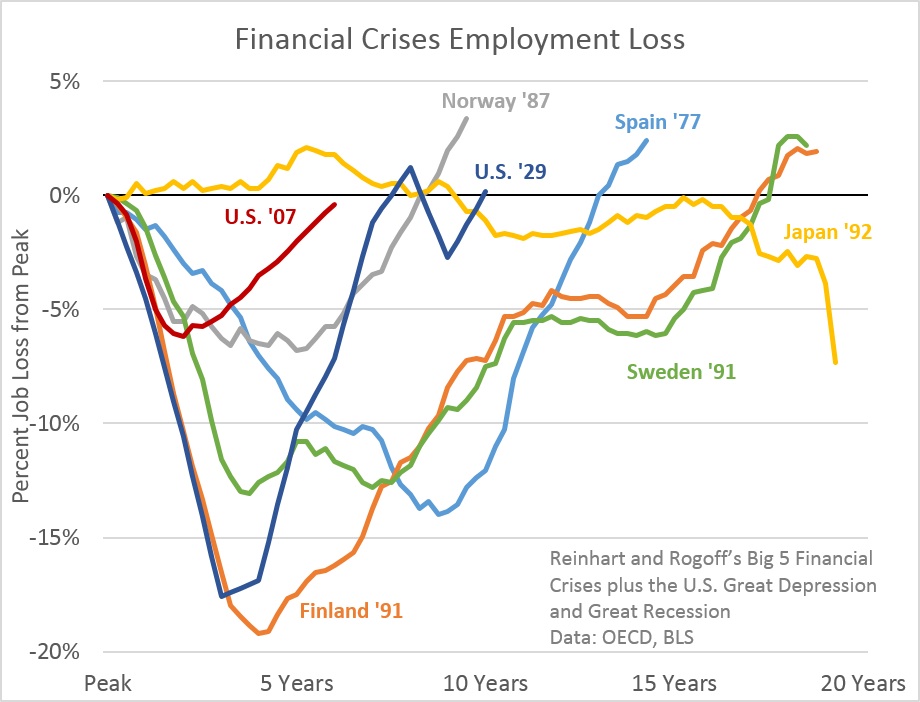

Another view is that the recovery has not been bad and in fact, when compared to other recessions that were accompanied by a financial crisis, this recovery is actually a pretty good one. According to the Oregon Office of Economic Analysis, "In terms of employment, the U.S. has actually done fairly well when compared with these other, major crises. Not good enough overall to avoid mass unemployment and lackluster growth, but in the context of historical financial crises, the U.S. employment picture is better than most.” The chart below compares employment loss for Carmen Reinhart and Ken Rogoff’s so-called Big 5 financial crises with the U.S. Great Depression and Great Recession.

If you don’t have a job, it’s meaningless to learn that relative to the other awful times when people were unemployed, this time is actually better. But from a long-term economic perspective, maybe everyone was expecting a bit too much from the recovery, based on how bad the Great Recession and the near-financial crisis were. That’s why it may this jobs report really was good, but just not great.

MARKETS: Did anyone notice that the NASDAQ has been rolling over lately? Since touching its 14-year high on March 6th, the tech-heavy index is down 5.6 percent. The once-high flying Internet index is down 14.5 percent from its March 6 peak, though still remains up 41.6 percent from a year ago and the Biotech Index is off 17.4 percent from its February 25 high, but is also up 41 percent from a year ago. The money from these momentum stocks has not left the market yet, but is rotating to more defensive value-oriented companies, which is why the Dow and S&P 500 continue to flirt with new all-time highs.

- DJIA: 16,412, up 0.6% on week, down 1% YTD

- S&P 500: 1865, up 0.4% on week, up 0.9% YTD

- NASDAQ: 4127, down 0.7% on week, down 1.2% YTD

- 10-Year Treasury yield: 2.73% (from 2.75% a week ago)

- April Crude Oil: $101.14, down 0.5% on week

- June Gold: $1303.50, up 0.7% on week

- AAA Nat'l average price for gallon of regular Gas: $3.57 (from $3.63 a year ago)

THE WEEK AHEAD: Just like clockwork, here comes another round of corporate earnings. Most analysts believe that the bad weather hurt profitability.

Mon 4/7:

3:00 Consumer Credit

Tues 4/8:

Alcoa

7:30 NFIB Small Business Optimism Index

10:00 Job Openings and Labor Turnover Survey (JOLTS)

Weds 4/9:

2:00 FOMC Minutes

Thurs 4/10:

Chain Store Sales

8:30 Weekly Jobless Claims

8:30 Import/Export Prices

Fri 4/11:

JP Morgan Chase, Wells Fargo

8:30 Producer Price Index

9:55 Consumer Sentiment

Photo credit: www.LendingMemo.com

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)