What is Brexit? Borrowing from the mash up “Grexit,” which referred to the potential exit of Greece from the eurozone, “Brexit” is used to describe the referendum ("Should the United Kingdom remain a member of the European Union or leave the European Union?"), to be held on June 23rd. British, Irish and Commonwealth citizens who live in the UK, along with Britons who have lived abroad for less than 15 years, will determine whether to “leave” or “remain” in the EU.

What is the European Union? In 1957, the Treaty of Rome created the European Economic Community (EEC), or "Common Market," which was the basis of what is now known as the European Union, or “EU”. The idea behind the EU was that countries that trade with one another become economically interdependent and more likely to avoid conflict, a pressing concern in the shadow of two world wars on the Continent.

There are 28 member-nations in the EU: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the UK.

What is the Eurozone? The eurozone is a subset of the EU that shares a common currency, the euro. The Treaty of Rome, the Single European Act of 1986 and the 1992 Maastricht Treaty all paved the way for the Economic and Monetary Union (EMU) and a single currency -- the euro.

The currency was launched in 1999 for electronic transactions, and physical notes and coins were first issued in 2002. The 11 initial members of the EMU included: Austria, Belgium, Finland, France, Germany, Italy, Ireland, Luxembourg, Netherlands, Portugal, and Spain. Greece joined in 2001, followed by Slovenia in 2007, Cyprus and Malta in 2008, Slovakia in 2009, Estonia in 2011, Latvia in 2014 and Lithuania in 2015. Today, the euro area numbers 19 EU Member States.

Do all EU countries use the Euro? No. Three of Europe's largest economies -- Norway, Sweden, and the United Kingdom -- do not use the euro. Great Britain maintains its own currency, the Pound Sterling.

What is the “Leave” Argument? Those who are in support of leaving say membership in the EU has led to high levels of immigration (one main tenant of EU membership is "free movement", which means you don't need to get a visa to go and live in another EU country); too many rules and regulations; and high costs. UK Treasury figures show that net contribution to the EU (including a negotiated rebate and money that is paid but sent) is £7.1 billion or $10.2 billion. The Leave argument is that not only would the UK save that money, but as Europe’s second-biggest economy, it could negotiate a better trade deal as a non-EU member.

What is the Remain Argument? Trading with other EU nations, as well as an influx of immigrants is good for the U.K. economy, according to the Remain camp. Additionally, there is a fear that if the U.K leaves the EU, international businesses will flee the UK, in search of a home in another EU nation.

What’s Expected? Recent opinion polls have shown a dead heat, but bookmakers’ odds still point to a victory for “Remain”.

When will we know the results? Polls close at 22:00 GMT (6:00ET) Thursday, 23 June and most believe that it will take about 6 hours to get a clear picture of who won, especially if the vote is as close as anticipated.

If “Leave” wins, how long will it take for Britain to leave the EU? Following a vote to leave, the UK government would have to decide when to invoke Article 50 of the Treaty of Lisbon, which outlines the legal process by which a state can withdraw from the EU. Once it does, the UK and the EU would begin to negotiate a withdrawal agreement, which at a minimum would be two years.

During the negotiation process, the UK would obey EU treaties and laws, but not take part in any decision-making, as it negotiated a withdrawal agreement. That period could be extended by unanimous agreement, which is why many analysts believe that it could take four or five years to tackle the myriad of issues, the biggest of which is how trade would be handled between the EU and the rest of the world. If the UK wanted to rejoin the EU, it could, but it would have to start the process from scratch.

If “Leave” wins, would other nations, like Greece, follow? Brexit could potentially be the first step towards the break-up of the EU, or the exit of one or more countries from the euro. Additionally, many believe that Scotland would launch a second effort to leave the U.K. – the first occurred about two years ago.

What are the market implications of Brexit? A vote to leave would negatively impact the British Pound, UK interest rates and stocks. According to the IMF, Brexit would likely plunge the UK into recession and could spark a stock market crash and a steep fall in house prices. It could also potentially create spillover effects in global markets, as uncertainty, the enemy of investors, would dominate. If Leave wins, economists expect UK GDP to shrink by 1.5 to 4.5 percent by 2021.

What are the political implications of Brexit? A Leave vote could see the departure of Prime Minister David Cameron, who started this risky process after he won the 2015 general election. Cameron was responding to pressure from his own Conservative MPs and the UK Independence Party (UKIP), both of which had heard from disgruntled constituents about the issue of EU control.

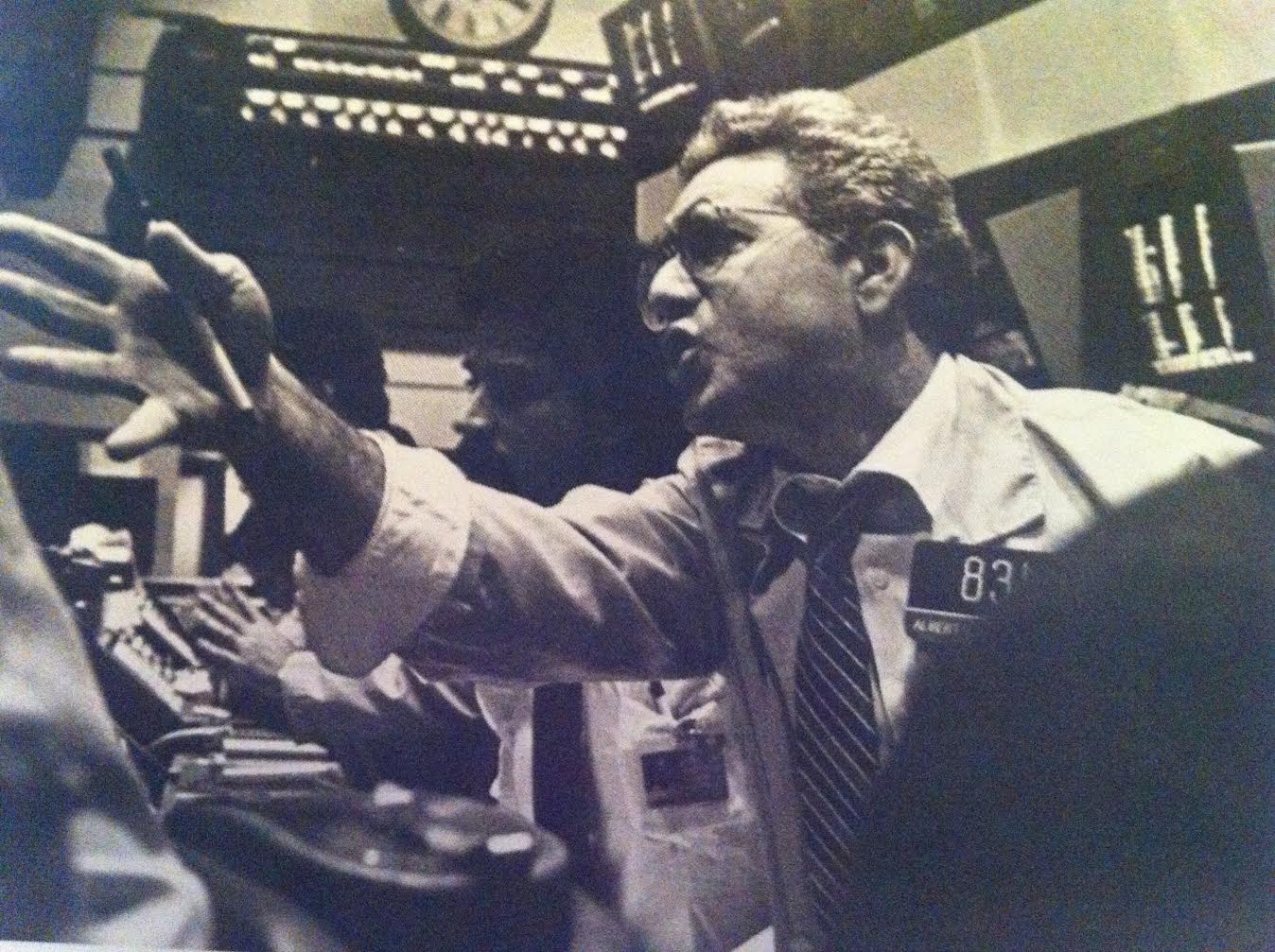

MARKETS: It was a “risk-off” week, as the combination of loose global central bank policies, worries over economic growth and fear over Brexit pushed investors into the sovereign bond markets. On Tuesday, the yield of the German 10-year bond fell below zero for the first time ever. The S&P 500 and NASDAQ had their largest weekly drops since late April.

- DJIA: 17,675 down 1% on week, up 1.5% YTD

- S&P 500: 2071 down 1.2% on week, up 1.3% YTD

- NASDAQ: 4800 down 1.9% on week, down 24.1% YTD

- Russell 2000: 1145, down on week, up 2.5% YTD

- 10-Year Treasury yield: 1.61% (from 1.64% a week ago)

- July Crude: $47.98, down 2.2% on week

- August Gold: $1,294.80, up 1.5% on week

- AAA Nat'l avg. for gallon of reg. gas: $2.34 (from $2.34 wk ago, $2.80 a year ago)

THE WEEK AHEAD:

Mon 6/20:

Tues 6/21:

10:00 Janet Yellen’s semi-annual testimony before Senate Banking Committee

Weds 6/22:

10:00 Janet Yellen’s semi-annual testimony before House Financial Services

10:00 Existing Home Sales

Thursday 6/23:

UK BREXIT VOTE

10:00 New Home Sales

Friday 6/24:

8:30 Durable Goods Orders

10:00 Consumer Sentiment

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)