This is my third Father’s Day without a father and it still seems strange that he’s not here. I think about Albie (“Albert” to my grandmother, “Big Al” to others) every day and especially now, as we celebrate my niece’s and nephew’s high school and college graduations; new career turns for various family members; and some amazing career highlights for me, including a once-in-a-lifetime opportunity to interview Dame Julie Andrews. But it’s when my attention turns to markets and the economy that I often hear Albie offering a no-baloney quip that would cut to the core of any issue of the day. I could imagine him describing the current investment environment like this: “Every asset class stinks, but cash is the best of the worst.” Or sarcastically referring to big investment firms’ opposition to the Department of Labor’s Fiduciary Rule: “Only these geniuses think that NOT putting the client first is a smart business proposition.” And to investors who pile into expensive, but poor performing hedge funds: “Just because they have money does not make them smart.”

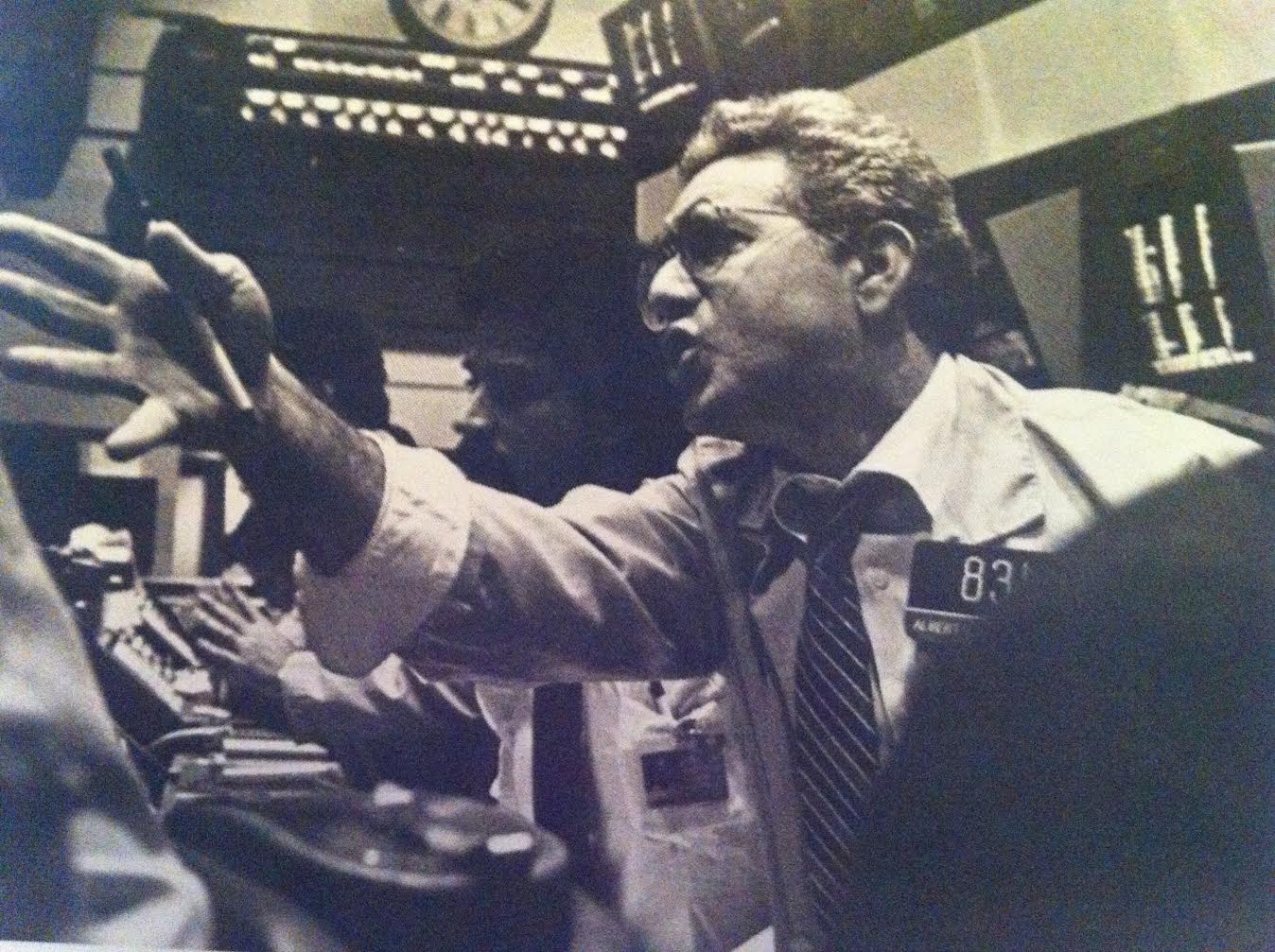

You might think that as a former options trader on the floor of the American Stock Exchange (AMEX), my father would have been a big risk-taker, but as he admitted “Going broke a couple of times tends to cure one of swinging for the fences.” Dad developed a healthy respect for risk -- similar to the one he had for swimming in the ocean. When the water is calm, you feel brave and alive, but when a wave sweeps you off your feet, you are humbled.

As he matured, my father learned to be a more patient and disciplined investor and although I never liked his proclivity towards being an individual stock and bond picker, I knew that his mantras (“Nobody rings a bell at the top or the bottom”, “don’t fall in love with your positions”, “wait 24 hours before making any major purchase or sale that deviates from the plan”) kept him out of any serious trouble.

My father was a bit of a contrarian, something that used to drive me crazy. But what seemed annoying as a kid, was actually a good habit to develop: questioning the status quo, especially when articulated by so-called experts, helped me avoid being swept up in various investment manias – and freaked out about crashes – over the years. It also allowed me to consider some of Albie’s favorite challenges to conventional wisdom: Why is home ownership preferable to renting? Aren’t there cases when renting makes sense? Is attending an expensive college really worth it? Why doesn’t everyone realize that financial planners/brokers/advisers consistently fall prey to their own optimism? What if you are unable to earn 6 percent on your retirement assets? Why are people so unwilling to talk plainly about money and death?

I had lengthy conversations with my father about all of those questions and many more, including debates on sports, politics, television and movies. I was thinking about Albie after reading a report from Allianz, which found that sobering third of Americans say they regret the major choices they made in their lives, such as when/where they went to school, the profession they chose and when/where they worked. My father was the type of man who had no regrets, not even for the mistakes that he made.

On what would be the last Father’s Day we spent together, he said, “The best thing I have ever have done in my life was to raise two wonderful daughters.” He wasn’t gooey when he said it— for him, it was a statement of fact. For me, it’s the best way to remember Albie.

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)