March 9 2014 marks the five-year anniversary of the stock market’s recent bear market closing low. That trading day, the Dow Jones Industrial Average was at 6547, its lowest level since April 15, 1997; the S&P 500 was at 676, its lowest level since Sept 12, 1996; and the NASDAQ was at 1268, its lowest level since Oct 9, 2002.

Since then, U.S. markets have charged higher. Through the end of February, the S&P 500 has shot up 175 percent and including dividends, returns have more than tripled since the bear market low. For the first few years of the recovery, ordinary investors were largely on the sidelines. The experience of watching a retirement account plunge by half prompted many to say that they would never again put themselves through the pain. But over the past few years, many risk-averse investors have reentered the market, though this time, hopefully a little bit wiser.

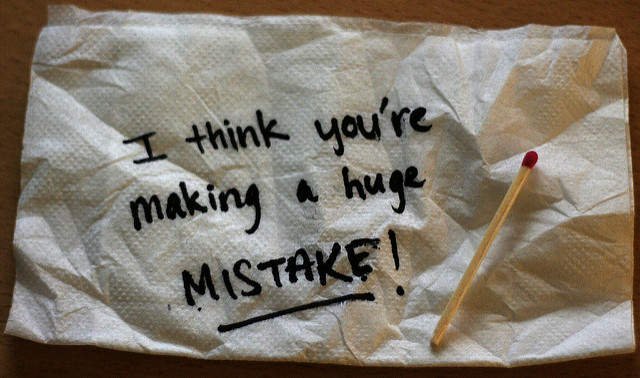

Not so fast. According to Morningstar, which regularly reviews investors' performance results versus the funds that they own, people are lousy investors. In fact, in the ten years through the end of 2013, the typical investor lagged the mutual funds in which she was invested by 2.5 percent EACH year. What explains the underperformance? We are mere mortals, who are prompted to make emotional decisions -- at precisely the wrong times -- in our portfolios!

There are two main emotions that infect most investors: fear and greed. In 2007, when stocks were flying high and financial crisis had not yet entered the vernacular, many allowed greed to rule, piling into risky asset classes, like stocks. Then at some point, maybe near the bottom in 2009, or even earlier in 2008, fear prompted many to sell.

Conversely, those who adhered to a more balanced approach were better able to keep those emotions in check. Yes, you may have been handsomely rewarded if you kept all of your money in stocks from the bottom until today, but the fact that so much of your nest egg was vanishing before your eyes in 2008-2009, made it more likely that you would not be able to withstand the pain. That's why the unsexy advice of maintaining a thoughtful, balanced approach to investing, which incorporates periodic rebalancing, can help you avoid the emotional decisions that greed and fear often prompt.

Here are the three ways to keep fear and greed in check:

1. Keep cool: If you had sold all of your stocks during the first week of the crisis in September 2008, you would have been shielded from the additional losses that occurred until March 2009. But how would you have known when to get back in? It is highly doubtful that most investors would have had the guts to buy when it seemed like stock indexes were hurtling towards zero.

2. Maintain a diversified portfolio and don’t forget to rebalance. One of the best ways to prevent emotional swings is to create and adhere to a diversified portfolio that spreads out your risk across different asset classes, such as stocks, bonds, cash and commodities. In September 2008, a then-client shrieked to me that “everything is going down!” But that was not exactly the case: the 10 percent allocation in cash was just fine, as was the 30 percent holding in bonds. That did not mean that the stock and commodities positions were doing well, but overall, the client was in far better shape because she was diversified.

3. Maintain a healthy emergency reserve fund. Bad luck can occur at any time. One great lesson of 2008-2009 is that those who had ample emergency reserve funds (6 to 12 months of expenses for those who were employed and 12 to 24 months for those who were retired) had many more choices than those who did not. While a large cash cushion seems like a waste to some (“it’s not earning anything!”), it allowed many to refrain from selling assets at the wrong time and/or from invading retirement accounts.

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)