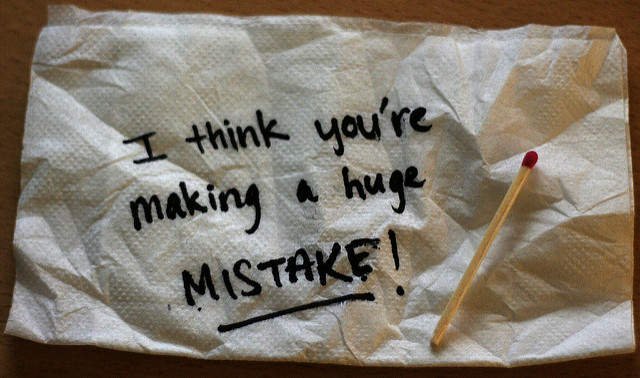

Some retirement mistakes are out of our control. For example, you may decide to call it quits amid a terrible recession, which can upend all of the best calculations in the world. But there are plenty of missteps that we can easily avoid, with just a bit of attention and planning. Here are my top 5 Retirement Plan Mistakes to Avoid. 1. Withdrawing instead of Rolling Over: During the recession, many were forced to take withdrawals from their retirement accounts to survive. Unfortunately, there are still too many workers who leave their jobs, cash out plan assets and pay a tax penalty, instead of rolling over the funds into another retirement account. Cash-outs are most prevalent among younger workers, the ones who would most benefit from keeping the money in a tax-deferred retirement account.

Plan administrators usually automatically withhold 20 percent of the balance and sends that amount to the IRS. In addition to federal and state income tax, investors younger than 59½ who cash out have to pay a 10 percent early withdrawal penalty. The potential result: Cashing out $50,000 in 401(k) savings may leave just $35,000 in cash. And regardless of the age, the retirement saver who withdraws plan assets no longer gets the compounded growth the savings would have occurred in the account.

2. Not Rebalancing: The old “set it and forget it” mentality can be problematic, because it can ensnare you in one of the classic retirement plan mistakes: Not rebalancing on a periodic basis (quarterly, biannually or annually). It has gotten easier to complete this task, because a lot of plans now have an auto-rebalance option. A side benefit of using this feature is that it can help take emotions out of the investment process, essentially forcing you to buy low and sell high.

3. Not Diversifying/Owning too Much Company Stock: You know that you shouldn’t put too many eggs in one basket. But some participants don’t realize how much overlap they may have among their retirement funds. It’s far more important to diversify among asset classes (stocks, bonds, commodities and cash) than in the total number of funds. Additionally, if your company stock is an option in your plan, limit your exposure to five percent of your total investment holdings. Sure, the stock may be awesome now, but do you really need to risk your retirement on the company’s performance? Since many companies match in their stock, it is incumbent on you to keep an eye on your allocation…or use that auto-rebalance!

4. Choosing High-Fee Mutual Funds: One way to increase your return without risk is to reduce the cost of investing. If your plan offers index funds, you may be able to save for retirement at a fraction of the cost of managed funds. If your plan is filled with expensive funds, gather your co-workers and lobby your boss to add low-cost index funds to your plan.

5. Tapping Retirement Funds to Pay Down a Debt: Workers sometimes dip into retirement funds to whittle away their outstanding credit card balances and other bills. While the IRS does allow for hardship withdrawals in certain instances, pulling money from retirement accounts should be a last resort, due to the aforementioned fees and taxes. Additionally, many workers who are over 59 ½ are tempted to use retirement assets to pay down a mortgage as they approach retirement. The biggest risk in doing this is that you may deplete your liquid assets to eliminate a debt on a non-liquid one.

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)