In honor of National Estate Planning Awareness Week, I talked to two different professionals, each of whom offered specific advice about how to conduct difficult family conversations about money in general, and estate planning specifically. Why is this topic so hard? “Because feelings and money get tied up,” says psychologist Lisa Damour. Money can evoke feelings of control (or lack thereof), privacy, dignity, shame, fear and lack of confidence. And when we express our concrete views on financial matters in a way that minimizes the emotional aspects, things can get thorny. Just imagine an exchange like this:

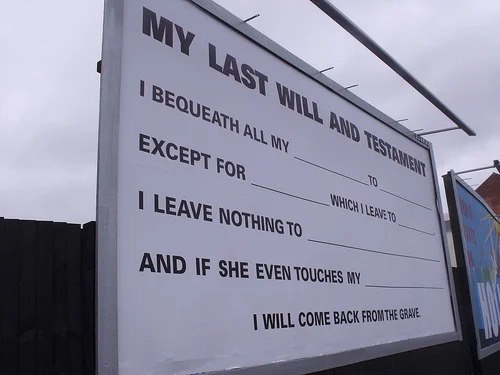

Son (age 40): “Mom, have you and Dad updated your will recently?”

Mom (age 75): “Why—are you hoping that we will die soon, so you can finally pay off that big mortgage that we warned you not to take?”

You can see how these kinds of conversations can go downhill pretty fast, which is why each side needs to resist the urge to grab whatever bait is thrown out. After all, you are not going to litigate your entire relationship with your parents or your adult children during these interactions. Just like she tells parents of teenagers to “not take anything that they say so personally”, Damour’s advice applies to discussing financial and estate issues with your loved ones.

Instead, of jumping in full throttle, estate attorney Virginia Hammerle says that it is helpful “to focus on an isolated issue, like titling of a bank account or making a beneficiary designation,” which can lead to a broader discussion on family finances and estate planning.

Once you break the ice and start the process, it is helpful to ask what goals you are trying to accomplish. Do you want to ensure that your assets will be passed to the next generation and beyond? Are you worried that one of your heirs will squander any money that is left to him or her? Do you want to be charitable? Are you anxious that you will offend one of your heirs? The good news is that by discussing your concerns with a qualified estate attorney, you can build a plan that addresses the issues that currently exist. Remember not “to get stuck on the next fifty years,” says Hammerle. “Every estate plan can be changed and in fact should be revisited every few years. Here are the basic documents that you will likely draft:

- Will: Ensures that assets are passed to designated beneficiaries, in accordance with your wishes. In the drafting process, you name an executor, the person or institution that oversees the distribution of your assets. If you have minor children, you need to name a guardian for them.

- Letter of Instruction: This may contain appointment of someone who will ensure for the proper disposition of your remains, creepy, but important if you are choosing a method that is contrary to your family’s tradition.

- Power of Attorney: Appointment of someone to act as your agent in a variety of circumstances, like withdrawing money from a bank, responding to a tax inquiry or making a trade.

- Health Care Proxy: Appointment of someone to make health care decisions on your behalf if you lose the ability to do so

- Trusts: Revocable (changeable) or irrevocable (not-changeable) trusts may be useful, depending on family and tax situations. For 2016, the first $5.45 million of an estate is exempt from federal estate taxes. If an estate is above the threshold (or twice that for married couples), you may want to consider a trust.

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)