“How can the stock market go up, while the economy is still struggling to recover amid the pandemic?” The answer is that the stock market is not the economy and vice versa.

CBS This Morning: Economic Turmoil

The Dow and NASDAQ’s Friday closing numbers marked the end of U.S. markets’ worst week since the 2008 financial crisis. The economic fallout has also lead to massive layoffs and predictions of an unprecedented slowdown. I joined CBS This Morning: Saturday to break down the latest financial information.

Pandemic Economy: Winter Has Come

CBS This Morning: Market Volatility

The New York Stock Exchange will temporarily close its famous trading floor on Monday after two people tested positive for the coronavirus. Trading is set to resume electronically. On Wednesday, the Dow closed below 20,000, erasing nearly all its gains since President Trump took office. I joined CBS This Morning with reaction to the extreme economic uncertainty.

CBS Evening News: Dow Falls 3,000 Points

Financial markets suffered losses of historic proportions Monday, with the Dow falling almost 3,000 points, the biggest one-day point drop of all time. The tumble comes as President Trump concedes the country "may be" heading for a recession. Here’s my report for the CBS Evening News.

Fed Action and Coronavirus Bear Market 2020

CBS Evening News: Dow Recovers After Brutal Week

The stock markets ended a brutal week on a positive note. The Dow bounced back by nearly 2,000 points, picking up more than 9% on Friday. Here’s my report from the CBS Evening News.

CBS Evening News: Meltdown on Wall Street

The Dow plummeted nearly 10%, leaving investors fearing that the government has not done enough to help the economy amid the coronavirus pandemic.

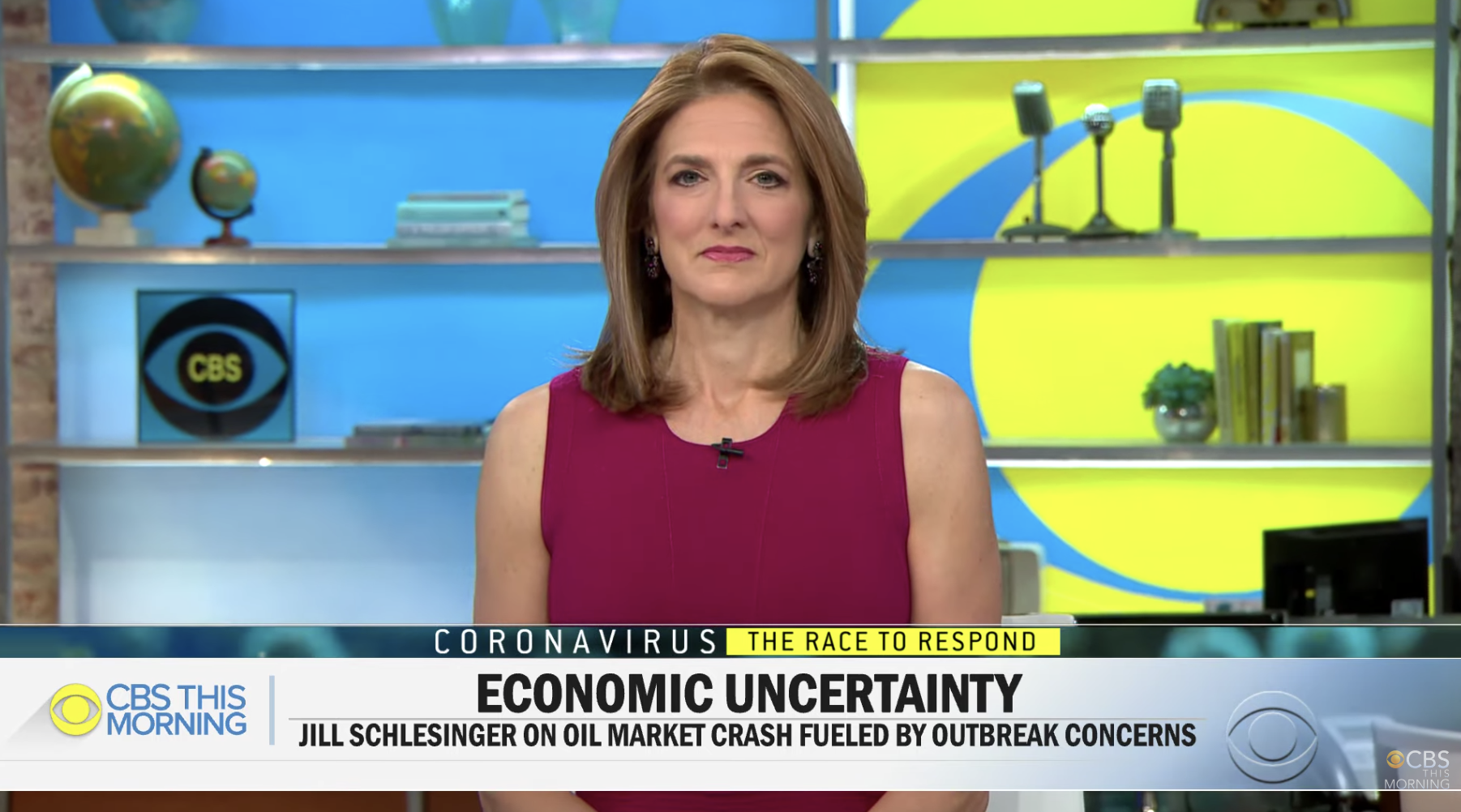

CBS This Morning: Oil Market Crash

Another day of big losses on Wall Street, after oil markets plunged overnight. Markets in Australia, Japan and parts of Europe are down more than 5%, adding to the economic uncertainty blamed on the coronavirus. I joined CBS This Morning to explain what's going on amid the spread of coronavirus.

The Global Impact of the Financial Crisis

When we think back to ten years ago and the events of the financial crisis, such as the fall of Lehman Brothers and the bailout of AIG, it’s easy to only recall what happened in the U.S.

But in reality, the crisis was an enormous global mess, and one that actually started in Europe.

That’s why today we’re joined by Adam Tooze, professor of history at Columbia University and author of Crashed: How a Decade of Financial Crises Changed the World.

Tooze delivers an in-depth reinterpretation of the 2008 economic crisis as a global event that directly led to the shockwaves being felt around the world today.

In September 2008 President George Bush could still describe the financial crisis as an incident local to Wall Street.

In fact it was a period of dramatic global significance that spiraled around the world, from the financial markets of the UK and Europe to the factories and dockyards of Asia, the Middle East, and Latin America, forcing a rearrangement of global governance.

In the United States and Europe, it caused a fundamental reconsideration of capitalist democracy, eventually leading to the war in the Ukraine, the chaos of Greece, Brexit, and the eventual election of Donald Trump.

It was the greatest crisis to have struck Western societies since the end of the Cold War, but was it inevitable? And is it over?

Crashed is a narrative resting on three original themes:

The haphazard nature of economic development and the erratic path of debt around the world

The unseen way individual countries and regions are linked together in deeply unequal relationships through financial interdependence, investment, politics, and force

The ways the financial crisis interacted with the rise of social media, the crisis of middle-class America, the rise of China, and global struggles over fossil fuels

Given this history, what are the prospects for a stable and coherent world order?

“Better Off” is sponsored by Betterment.

Have a money question? Email us here or call 855-411-JILL.

We love feedback so please subscribe and leave us a rating or review in Apple Podcasts!

Connect with me at these places for all my content:

https://twitter.com/jillonmoney

https://www.facebook.com/JillonMoney

https://www.instagram.com/jillonmoney/

https://www.linkedin.com/in/jillonmoney/

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)