Happy Thanksgiving! I know it’s a weird one this year, but I hope everybody is getting to enjoy it in some way, shape, or form.

Holiday or no holiday, the Jill on Money show carries on, so let’s get started with your emails and a caller who has every reason to be incredibly thankful this holiday weekend.

It’s a family affair in hour two as we bring you two separate interviews from the Schwab family.

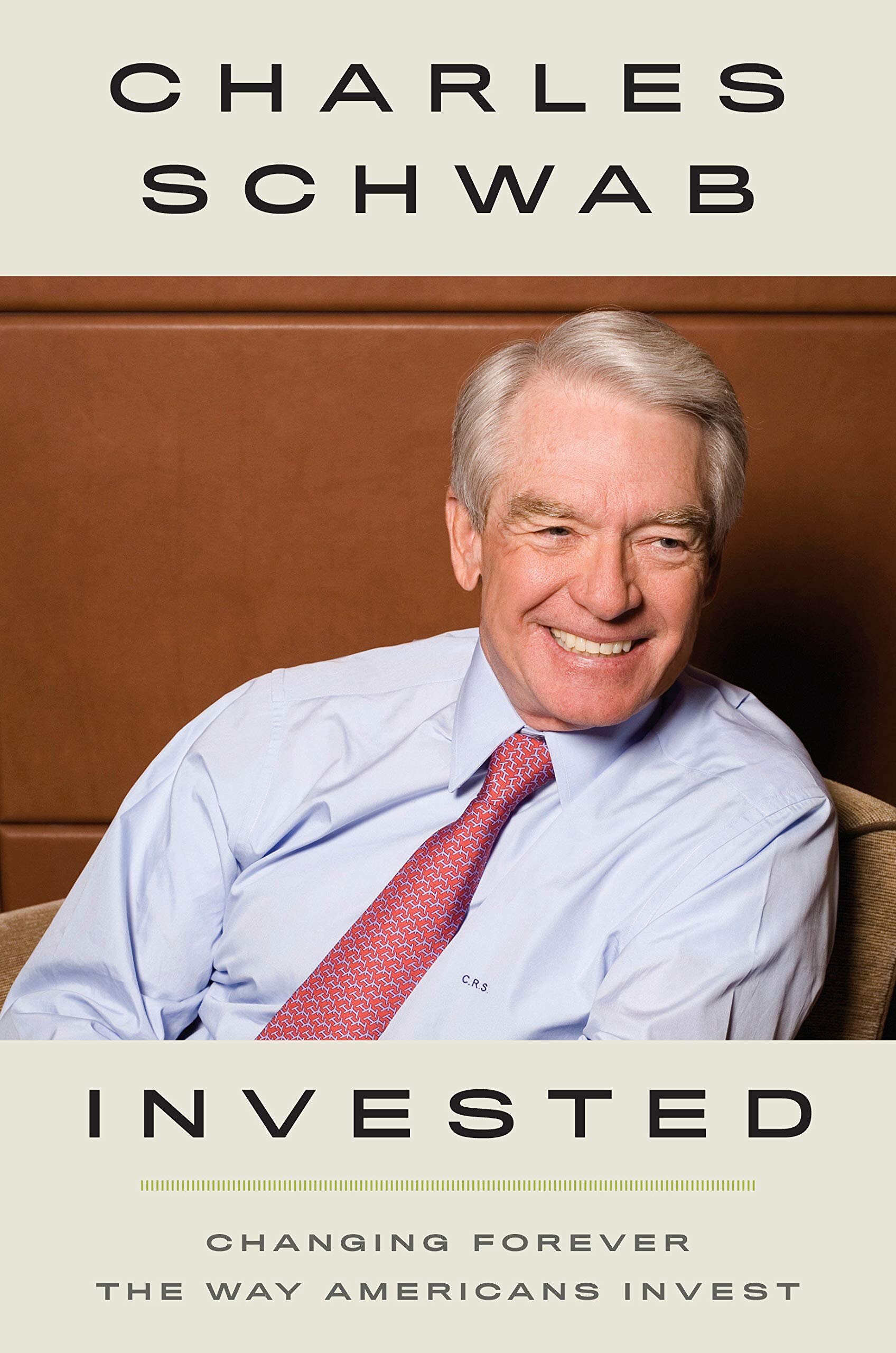

First up is Charles Schwab, yes, that Charles Schwab, the founder of The Charles Schwab Corporation.

He joined us in-studio (pre-pandemic) to talk about his personal memoir, Invested: Changing Forever the Way Americans Invest, in which he describes his passion to have Main Street participate in the growing economy as investors and owners, not only earners.

Schwab opens up about the challenges he faced while starting his fledgling company in the 1970s and recounts the company’s game-changing sale to Bank of America, and how, in the end, the merger almost doomed his organization.

We finish up the hour with Carrie Schwab-Pomerantz, who joined us to discuss a recent retirement survey conducted by Schwab.

The online survey was conducted among 2,000 Americans aged 55 to 75 with at least $100,000 in investable assets.

Among the findings:

More than 80% of those who have retired and those soon-to-retire believe their lifestyle in retirement will be everything that they envision

Aspiring retirees expect to retire six years later (at age 66) than accomplished retirees did

19% of survey respondents say they or their spouse were financially impacted by COVID-19

52% of respondents say they’re more focused on developing a retirement plan due to COVID-19

Have a money question? Email me here.

"Jill on Money" theme music is by Joel Goodman, www.joelgoodman.com.

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)