The financial freeze of COVID-19 is thawing. 2020 was the worst year for the U.S. economy in decades, but as vaccinations have ramped up and government stimulus efforts continue, 2021 has started on strong footing. The government reported that GDP, the broadest measure of growth, expanded at a 6.4 percent annualized rate, up from the fourth quarter reading of 4.3 percent.

“The pace of growth was the second largest in eight years, bested only by the reopening of the economy last summer,” says economist Joel Naroff. He’s referring to Q3 2020, when the pandemic yoyo bounced from its devastating 31.4 percent drop in Q2, to 33.4 percent growth. And at $22 trillion, GDP is just one percent smaller than it was at the end of 2019, and about 3.3 percent where it would have been, had the pandemic never occurred, making the current recovery one of the swiftest on record.

So, what’s behind the first quarter growth and can it continue for the rest of the year? The big boost for Q1 was personal income, which soared by about 60 percent from the previous quarter, primarily due to government stimulus checks and ongoing unemployment assistance.

A separate government report on March Personal Income and Spending underscored the importance of the $1,400 checks, says Naroff, “the money coming from government payments was nearly forty times as large as the additions to income from wages and salaries, even given the accelerated reopening of the economy.” In fact, the 23.6 percent surge in personal disposable incomes was the strongest monthly increase on record, the next closest was the 15 percent increase in April 2020, after the CARES Act $1,200 checks were sent.

Those numbers suggest “that the fiscal stimulus was a roaring success,” according to economist Paul Ashworth of Capital Economics. Although many saved those funds (the savings rate jumped to 21 percent, from 13 percent in Q4), plenty of individuals and businesses spent enough money to propel growth.

An odd twist of the pandemic economy is that the government’s multi-pronged response to it has improved the balance sheets of a wide swath of Americans. And many of them will open the spigots in the second quarter, and beyond, as they deploy some of their cash. The spending frenzy could add to the current wave of price increases, which were highlighted by the Procter & Gamble announcement that it would be raising prices on many consumer favorites in mid-September.

The Federal Reserve poo-pooed inflation fears, contending that a tick up in inflation will only be temporary (or “transitory” in Fed-speak) and that consumers do not believe that price increases will last too long. That fact, according to Powell, should allow the Fed to keep short-term interest rates “low for an extended period.” Many economists disagree. “What [the Fed has] now said is, we’re not going to do anything until we see a bunch of drunk people staggering around” said Former Treasury Secretary Lawrence Summers.

Grant Thornton Chief Economist Diane Swonk’s take is that “the Fed is more focused on getting people off the sidelines and dancing than throwing a frat party. They have looked in the mirror and realized their past mistakes; preemptive rate hikes left the economy with a residual chill. The inflation they anticipated never materialized.”

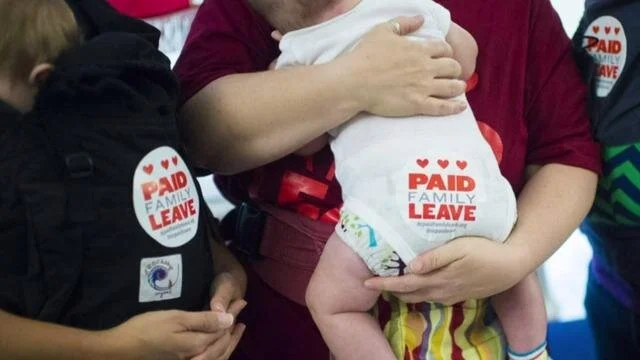

If inflation doesn’t snuff out the recovery, will higher taxes? That’s the question some are asking, in response to President Biden’s $1.8 trillion The American Families Plan. The plan is a combination of $1 trillion of spending over ten years and $800 billion worth of tax credits, which are currently temporary and would be made permanent. The proposal is focused on education, childcare, and paid family and medical leave and it would be funded by imposing higher taxes on the nation’s wealthiest families.

Here are the specific proposals:

Raise the top marginal tax rate from 37 percent to 39.6 percent. 39.6 percent might seem familiar, because it was the top level before the 2017 Tax Cuts and Jobs Act was enacted. In the Biden proposal, 39.6 percent would apply to taxable income earned for married couples above $509,300, and for individuals above $452,700, that was according to a White House official who had to clarify the initial numbers after there was confusion around the much-cited $400,000 level.

The current top income bracket for 2021 kicks in for income earned above $628,300 for those who are married filing jointly and above $523,600 for individuals. What’s important is not only that the top rate would rise, but that higher rate would be applied to income at a lower level. The White House points out that this change intends to reverse the 2017 tax cut for the top bracket and notably, the change would apply to less than 1 percent of American earners.

Change long term capital gains and qualified dividend rates for households making more than $1 million. Currently, assets held for more than a year are considered long-term and are subject to a separate tax structure than the money earned by working. Currently, there are three long term capital gains tax brackets, of which the top rate is 20 percent, which is assessed on asset sales to those with taxable income of more than $501,600 for couples and $445,850 for individuals.

Under the American Families Plan, if you make more than $1 million, the top capital gains rate would be subject to the top ordinary income tax of 39.6 percent (as noted above) plus the existing (and additional) 3.8 percent Affordable Care Act surcharge for a total of 43.4 percent. This would be a whopper of an increase from the current 23.8 percent top rate.

Change the way taxes are assessed on inherited assets. The current estate tax system allows for a “step-up” in cost basis at death. So that means that if I purchased a portfolio of stocks 50 years ago for $1,000 and it was worth $1,000,000 at my death, my descendants would inherit the portfolio as if they paid $1,000,000 for it. When they sell it, $1,000,000 would be the cost basis of the assets, which effectively means they would pay no tax on all of that accumulation.

Under the Biden plan, stepped up cost basis would be eliminated-for everyone, but there would also be a provision which would exclude up to $1,000,000 of gains from taxation. This is similar to the current rule on primary residence gains, which exclude the first $250,000 for individuals and $500,000 for couples.

Beef up IRS audits of high-income earners. The plan would provide the IRS with $80 billion to ramp up audits in an effort to collect an additional $700 billion over 10 years. While those claims may not bear out, it is clear the IRS has been underfunded, its budget has fallen by 20% in real terms over the past decade.

The plan is likely to go through the grinder of negotiations, but it is clear that the Biden Administration is likely to seek tax increases on the top one percent of U.S. earners.

![Jill on Money [ Archive]](http://images.squarespace-cdn.com/content/v1/59efbd48d7bdce7ee2a7d0c4/1510342916024-TI455WZNZ88VUH2XYCA6/JOM+Blue+and+White.png?format=1500w)